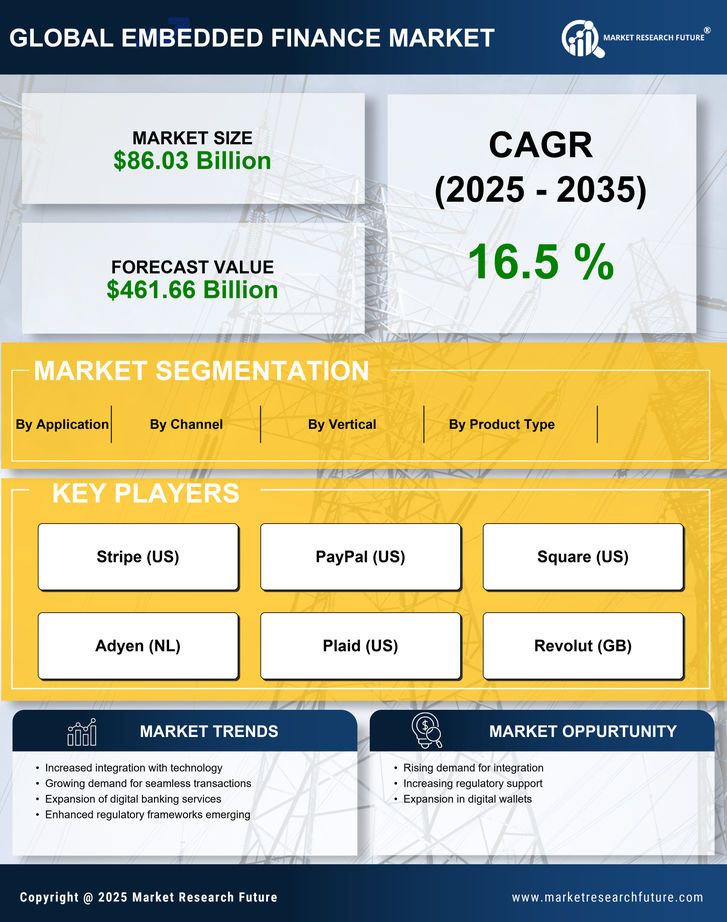

The Embedded Finance Market is characterized by intense competition among leading embedded finance companies, driven by innovation, partnerships, and expanding platform capabilities. These players continue to shape the trajectory of embedded finance growth through advanced APIs, payments infrastructure, and platform-based financial services. Key players such as Stripe (US), PayPal (US), and Adyen (NL) are at the forefront, leveraging their technological capabilities to enhance user experiences and streamline transactions. Stripe (US) focuses on innovation through its robust API offerings, enabling businesses to embed payment solutions seamlessly. PayPal (US), on the other hand, emphasizes strategic partnerships, expanding its ecosystem to include various financial services, thereby enhancing customer retention. Adyen (NL) adopts a global approach, optimizing its platform for diverse markets, which positions it favorably against competitors. Collectively, these strategies foster a competitive environment that prioritizes technological advancement and customer-centric solutions.In terms of business tactics, companies in the Embedded Finance Market are increasingly localizing their services to cater to regional preferences and regulatory requirements. This localization, coupled with

supply chain optimization, allows for more agile responses to market demands. The market structure appears moderately fragmented, with several players vying for dominance, yet the influence of major companies like Stripe (US) and PayPal (US) remains substantial, shaping industry standards and practices.

In August Stripe (US) announced the launch of its new embedded finance suite, which integrates banking and payment functionalities into a single platform. This strategic move is significant as it not only enhances Stripe's value proposition but also positions it as a comprehensive solution provider in the embedded finance space. By offering a unified platform, Stripe (US) aims to attract a broader range of businesses looking for streamlined financial solutions.

In September PayPal (US) expanded its partnership with various e-commerce platforms to enhance its embedded payment solutions. This initiative is crucial as it allows PayPal (US) to tap into new customer segments while reinforcing its presence in the rapidly evolving e-commerce landscape. The partnership strategy indicates a shift towards creating a more interconnected financial ecosystem, which could lead to increased transaction volumes and customer loyalty.

In October Adyen (NL) revealed its plans to enhance its fraud detection capabilities through advanced machine learning algorithms. This development is particularly relevant as it addresses growing concerns around security in embedded finance. By investing in technology that improves transaction security, Adyen (NL) not only protects its customers but also strengthens its competitive edge in a market where trust is paramount.

As of October the Embedded Finance Market is witnessing trends such as digitalization, sustainability, and the integration of artificial intelligence. These trends are reshaping competitive dynamics, with companies increasingly forming strategic alliances to enhance their service offerings. The focus appears to be shifting from price-based competition to differentiation through innovation and technology. As the market evolves, companies that prioritize reliability in their supply chains and invest in cutting-edge technology are likely to emerge as leaders in this rapidly changing landscape.