Elevators And Escalators Size

Elevators and Escalators Market Growth Projections and Opportunities

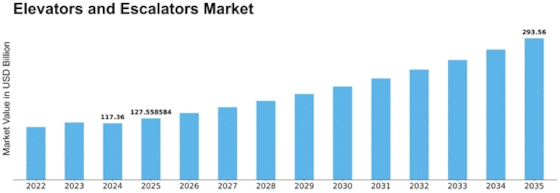

Elevators and Escalators Market Size was valued at USD 90.67 Billion in 2021. The Elevator and Escalators industry is expected to grow from USD 102.85 Billion in the year 2022 to USD 200.32 Billion by the year 2030, with a CAGR of 8.69% for the period of 2022-2030. A variety of market factors are responsible for changing the dynamics of the Elevators and Escalators market. One of the driving forces behind this market is the ongoing global urbanization trend, which results in significant growth in demand for elevators and escalators as vertical mobility solutions since more people relocate to cities in search of better mouthfuls and even job opportunities. Urbanization also leads to the construction of tall buildings, shopping malls, and residential apartments, leading to high demand for highly effective and reliable vertical movement devices. Additionally, technological advancements are reshaping Elevator and Escalators markets. Innovations such as smart lifts and energy-saving escalator systems are being introduced. Smart elevators incorporate features like predictive maintenance, destination dispatch systems, and touchless controls, among others, which improve user experience as well as operational efficiency. In addition, government regulations, along with building codes, play an important role in creating a framework within which the market can be shaped. Tight safety measures plus quality standards specified by regulatory agencies affect how designs are made; elevators are manufactured while escalator installation works are undertaken. The physical-economic factors that directly impact the Elevators and escalators market include GDP growth rate/investment in infrastructure projects. As a result, countries experiencing increased economic prosperity often witness augmented construction activities, thus leading to increased demand for vertical transportation solutions. The competitive landscape is another factor that affects market dynamics significantly. Key Player's Presence & Market Share – Key players contribute to the overall competitiveness of the industry through their presence & market share and strategic initiatives. Customer preferences and changing lifestyles also influence the market for elevators and escalators. There is a growing demand for luxury, high-speed lifts with advanced features as customers seek convenience and comfort. The COVID-19 pandemic has presented a set of unique challenges and opportunities to the Elevators and Escalators market. Various factors, including global urbanization trends, technological advancement, economic situation, regulatory issues, and customer preferences, shape this market.

Leave a Comment