Research Methodology on Electronic Countermeasures Market

Introduction

This research study offers a thorough analysis of the global Electronic Countermeasures Market. This research study incorporates both primary and secondary data sources to conduct a detailed and holistic analysis of the market. Firstly, the primary data sources include the interviews and questionnaire-based surveys administered to the leading market players and experts in the field of electronic market countermeasures. The questioned administered asked the respondent’s opinion related to market trends, drivers, challenges, dynamics, and others. All of this data is collected by expert analysts underlying the analysis framework of the report. Additionally, the secondary sources of the research comprise of reputed associations’ yearly records, regulatory organization websites, government sites, and other authentic sites. The competency of the gathered data has been checked further, and the validity of the report is crossed- checked with the help of third-party in-house data analysts.

Research Methodology

This report is based on the secondary data, primary research, and in-depth analyses to provide comprehensive insights into the global Electronic Countermeasures Market. The analysts have examined the current dynamics of the market and studied the factors that sustain the market growth and those that cause its declines.

In order to gain sufficient data for this report, a variety of interviews, newsletter subscriptions, conferences, internal and external sources, industry magazines, news articles, and publications were conducted with professional experts in the respective industries. The experts were from the sales and marketing fields of the leading companies operating in the Global Electronic Countermeasures Market.

The data was collected based on the scope and objectives of the research. A top-down and bottom-up approach was used to assess the quantitative and qualitative aspects of the report. The associated sources of data were identified to study the impact of the market.

Moreover, the data was collected from national and foreign trade organizations, such as the American Electronics Association (AEA), European Association for Microelectronic Packaging (EPMA), World Trade Organization (WTO), market research firms, and market intelligence reports. The data collected from these sources is segregated in terms of type, application, end-user, region, and country.

The secondary data was collected from the sources mentioned above and was used to assess the qualitative aspects of the research. The figures used in the analysis of the global Electronic Countermeasures Market are from previously published reports.

Data analysis and Validation

Once the data was collected from the various sources, it was then further analyzed and filtered through filtering software and aggregators. This was then aggregated and coded into appropriate categories, such as product types, end-users, applications, and regions.

After the data was collected from varied sources, it was further subjected to a number of validation and analysis procedures, such as linear regression, difference analysis, correlation analysis, descriptive analysis, and statistical analysis to assess the accuracy and validity of the collected data. Statistical analysis was conducted by using SPSS, Microsoft Excel, and R software. The report is then prepared with the help of a variety of analysis tools and techniques, such as Porter’s Five Forces Analysis, Market Share Analysis, SWOT Analysis, and others.

The report provides both a qualitative and quantitative analysis of the global Electronic Countermeasures Market with detailed insights into the market dynamic to offer up-to-date and reliable information.

To further understand the global electronic countermeasures market, the report used product life cycle analysis, value chain analysis, competitor analysis, and customer surveys.

Market Estimation

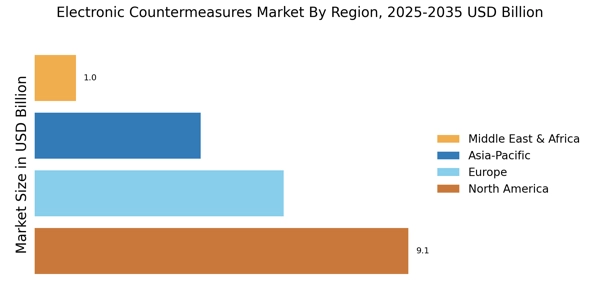

This research study also offers the market estimation of the global Electronic Countermeasures Market. This estimation was performed using market segmentation, which takes into consideration the end-user, types, applications, and regions. The market share of each segment and its contribution to the overall market was taken into consideration for the market estimation. The market size was estimated based on the annual revenue of the respective market.

Conclusion

The thorough research laid the basis of this study and hence the market estimation is reliable and authentic. This research report provides a 360-degree analysis of the global Electronic Countermeasures Market, incorporating an extensive analysis of the market trends, potential opportunities, leading market players, regional analysis, and the market dynamics. This report is a comprehensive resource that provides CXOs with insights into the market progress and the current industry developments. The study further assesses the overall market dynamics and provides the estimated market size in terms of revenue (US$ Mn) for the historical period, as well as for the forecast period, 2023 to 2030. Lastly, the research and analysis of the global Electronic Countermeasures Market are affected by several macro and micro environmental factors, such as: government regulations, economic situations, and technology advancements.