Growth in Consumer Electronics

The consumer electronics sector is witnessing a remarkable expansion, which is positively impacting the Electromagnetic Simulation Software Market. With the proliferation of smart devices, there is a growing need for electromagnetic compatibility testing to ensure that products function effectively without causing interference. The consumer electronics market is projected to reach over 1 trillion USD by 2025, highlighting the increasing demand for innovative products. This trend necessitates the use of advanced simulation tools to optimize device performance and compliance with international standards. As manufacturers strive to deliver high-quality electronics, the reliance on electromagnetic simulation software is expected to increase, driving market growth.

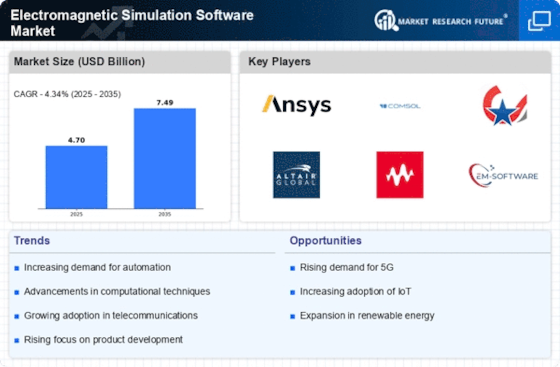

Rising Demand for 5G Technology

The increasing deployment of 5G technology is driving the Electromagnetic Simulation Software Market. As telecommunications companies expand their networks, the need for precise electromagnetic simulations becomes critical to ensure optimal performance and compliance with regulatory standards. The market for 5G is projected to reach substantial figures, with estimates suggesting it could surpass 700 billion USD by 2026. This surge necessitates advanced simulation tools to analyze and mitigate potential interference issues, thereby enhancing the reliability of 5G networks. Consequently, the demand for electromagnetic simulation software is likely to grow as companies seek to optimize their designs and validate their performance in real-world scenarios.

Regulatory Compliance and Standards

The increasing emphasis on regulatory compliance and industry standards is a key driver for the Electromagnetic Simulation Software Market. As governments and regulatory bodies establish stricter guidelines for electromagnetic emissions and compatibility, companies are compelled to adopt advanced simulation tools to meet these requirements. The market for compliance testing is projected to grow significantly, with estimates suggesting it could reach several billion USD in the coming years. This trend underscores the necessity for accurate simulations that can predict compliance outcomes and facilitate the design of products that adhere to regulatory standards. As a result, the demand for electromagnetic simulation software is likely to rise as companies seek to navigate the complexities of compliance.

Advancements in Aerospace and Defense

The aerospace and defense sectors are experiencing rapid advancements, which significantly influence the Electromagnetic Simulation Software Market. With the increasing complexity of aircraft and defense systems, there is a heightened need for accurate electromagnetic modeling to ensure safety and functionality. The market for aerospace simulation is expected to reach approximately 10 billion USD by 2025, indicating a robust growth trajectory. This growth is driven by the necessity for simulations that can predict electromagnetic interference and assess the performance of various components under different conditions. As a result, companies in these sectors are increasingly investing in sophisticated simulation software to enhance their design processes.

Emergence of Internet of Things (IoT)

The rise of the Internet of Things (IoT) is significantly shaping the Electromagnetic Simulation Software Market. As more devices become interconnected, the complexity of electromagnetic interactions increases, necessitating advanced simulation tools to ensure device compatibility and performance. The IoT market is anticipated to grow to over 1.5 trillion USD by 2025, indicating a substantial opportunity for simulation software providers. This growth is likely to drive demand for electromagnetic simulations that can accurately model the interactions between various devices and their environments. Consequently, companies are expected to invest in simulation software to enhance their IoT product offerings and ensure seamless integration.