Electrical Hospital Beds Size

Electrical Hospital Beds Market Growth Projections and Opportunities

In certain situations, patients encounter difficulties in maneuvering in and out of beds, prompting the significant role played by electrical hospital beds in addressing this challenge. These beds come equipped with features designed to facilitate patients in comfortably sitting up and exiting the bed. Moreover, electrical hospital beds have proven highly advantageous for medical practitioners during critical procedures and treatments. The market for these beds is fueled by various factors including a rise in acute and chronic illnesses, an increasing elderly population, a growing number of individuals dealing with obesity, ongoing advancements in hospital bed designs prioritizing patient comfort and improvement, and a surge in healthcare spending. However, the higher costs associated with electrical hospital beds pose a potential hindrance to market growth.

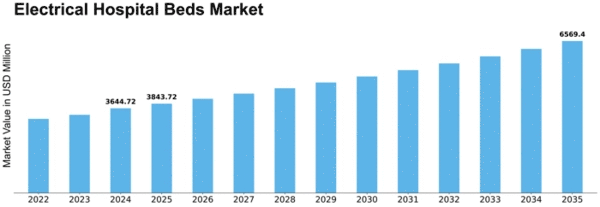

Projections suggest that the global electrical hospital beds market is expected to experience a Compound Annual Growth Rate (CAGR) of 7.25% from 2018 to 2023. In 2017, Europe led this market, securing a dominant share of 34.5%, closely followed by the Americas at 30.8% and Asia-Pacific at 24.6%. This growth is primarily driven by escalating demand for electrical hospital beds, advancements in healthcare technologies, and the expanding elderly population globally.

The global market for electrical hospital beds is categorized based on bed types, treatment variations, applications, end-users, and regions. Regarding bed types, the semi-automatic bed segment held the largest market share of 45% in 2017, amounting to a market value of USD 760.3 million. This segment is projected to maintain a steady growth with a forecasted CAGR of 5.07% during the estimation period.

Analyzing treatment types, the critical care segment accounted for the highest market share of 38% in 2017, with a market value of USD 647.4 million. Projections indicate a prospective growth rate of 8.03% during the forecast period for this segment.

In terms of application, the general-purpose segment dominated the market with a share of 32% in 2017, valuing USD 547.5 million. This segment is anticipated to exhibit a CAGR of 7.29% during the forecast period.

When considering end-users, hospitals and clinics claimed the largest market share at 40% in 2017, representing a market value of USD 674.5 million. Forecasts suggest a steady growth with a projected CAGR of 7.25%.

The demand for electrical hospital beds is propelled by their ability to address patient mobility issues. The market's growth is driven by various factors including healthcare advancements, an aging population, and the persistent need for enhanced patient comfort and treatment efficacy. Despite potential cost concerns, the market for electrical hospital beds is projected to exhibit significant growth across various bed types, treatment categories, applications, and end-users globally.

Leave a Comment