Electrical Bushing Size

Market Size Snapshot

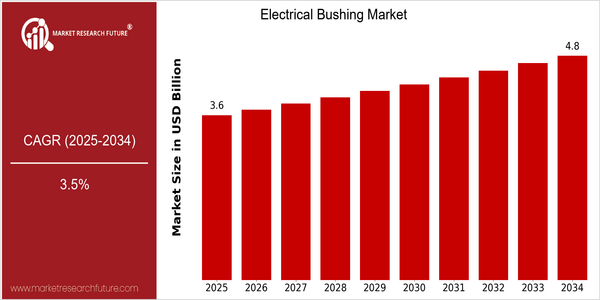

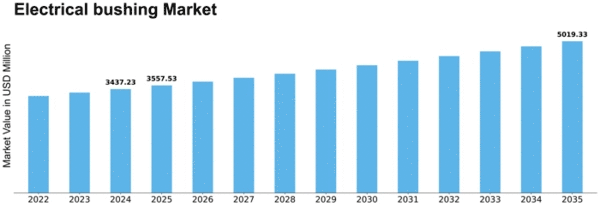

| Year | Value |

|---|---|

| 2025 | USD 3.56 Billion |

| 2034 | USD 4.85 Billion |

| CAGR (2025-2034) | 3.5 % |

Note – Market size depicts the revenue generated over the financial year

The electrical bushing market is expected to reach $ 3.56 billion in 2025 and is expected to reach $ 4.85 billion by 2034, at a CAGR of 3.5% during the forecast period. The high growth of the market is attributed to the increasing need for efficient power transmission and distribution systems, especially in emerging economies, where the need for a strong and sustainable power grid is paramount. Also, the increase in investment in the field of renewable energy and the modernization of the aging electrical grid are expected to drive the market. The key technological trends, such as the development of smart grids and the development of material science, are expected to have a significant impact on the electrical bushing market. The development of new insulating materials and designs, which improve the performance and reliability of bushings, is expected to encourage the investment of major players. The main players, such as Siemens, ABB and General Electric, are focusing on the development of new products and strategic alliances in order to strengthen their market position. For example, in order to meet the growing demand for sustainable energy solutions, Siemens has introduced a new line of environmentally friendly bushings.

Regional Market Size

Regional Deep Dive

ELECTRICAL BUDDENBROOK MARKET is experiencing a significant growth in several regions, owing to the rising demand for energy-efficient solutions and the expansion of the electrical network. In North America, the market is characterized by the increasing importance of renewable energy projects and the modernization of the aging network. Europe is experiencing a boom in the regulatory activities aimed at improving energy efficiency and the environment. The Asia-Pacific region is experiencing a rapid growth due to the industrialization and urbanization. Middle East and Africa are focusing on the investment in the electrical network. In Latin America, the focus is on the improvement of the electrical network for the economic growth.

Europe

- The European Union's Green Deal is pushing for stricter regulations on energy efficiency, leading to increased demand for high-performance electrical bushings in new installations.

- Companies such as ABB and Schneider Electric are actively involved in developing eco-friendly bushing solutions that comply with new environmental standards.

Asia Pacific

- China's rapid industrialization and urbanization are driving the demand for electrical bushings, with state-owned enterprises investing heavily in upgrading power transmission infrastructure.

- The Indian government has launched the 'Power for All' initiative, which aims to enhance electricity access and reliability, thereby increasing the need for robust electrical bushing systems.

Latin America

- Brazil's government is implementing policies to enhance its electrical grid, which includes the integration of advanced electrical bushings to support renewable energy sources.

- Chile is investing in solar energy projects, necessitating the use of high-quality electrical bushings to ensure system reliability and efficiency.

North America

- The U.S. Department of Energy has launched initiatives to promote the use of advanced electrical bushings in renewable energy projects, particularly in wind and solar power installations.

- Key players like Siemens and General Electric are investing in R&D to develop innovative bushing technologies that enhance performance and reliability in high-voltage applications.

Middle East And Africa

- The UAE's Vision 2021 is focusing on sustainable energy solutions, leading to increased investments in electrical infrastructure, including bushings for renewable energy projects.

- South Africa's Eskom is modernizing its power grid, which includes the replacement of outdated bushings to improve efficiency and reduce outages.

Did You Know?

“Electrical bushings are critical components that can operate under extreme conditions, with some designed to withstand temperatures exceeding 100 degrees Celsius.” — IEEE Power and Energy Society

Segmental Market Size

The electrical bushing market is currently experiencing a steady growth, which is mainly due to the growing demand for reliable electrical power transmission and distribution systems. The rising need for integration of the electrical grid with the power of renewable energy sources, which requires advanced electrical components, is also driving the growth of the electrical bushing market. Also, the technological developments in the materials and designs of electrical bushings have enhanced the performance and lifespan of these bushings, which has further added to the market growth. The electrical bushing market is currently at a mature stage, with the leading players, such as ABB and Siemens, offering new and advanced solutions in various regions, especially in North America and Europe. The major applications of electrical bushings are in transformers and high-voltage substations, where they act as critical interfaces between the electrical equipment and the external environment. The increasing trend towards smart grids and the global push towards sustainable development are also boosting the growth of the electrical bushing market. The technological developments, such as the use of composite materials and advanced insulating methods, are shaping the future of the market, thereby enhancing the efficiency of electrical bushings and reducing the maintenance costs.

Future Outlook

From 2025 to 2034, the market value of the global electrical bushing market is expected to grow at a CAGR of 3.5%. It is mainly influenced by the global trend of increasing the use of renewable energy sources and the modernization of aging electrical equipment. As more and more countries are investing in smart grids and sustainable energy, the use of advanced electrical bushings will also increase significantly, which will lead to a large number of new equipment and retrofits. Moreover, the development of composite and green materials will also promote the development of the electrical bushing market. This innovation not only improves the performance and service life of electrical bushings, but also meets the stricter requirements of the environment and the sustainable development of the industry. In addition, the high-voltage bushings are in great demand, especially in the field of energy-saving bushings. The electrical bushing market is expected to grow steadily, and the demand is expected to increase in the fields of power, industry, and wind power.

Leave a Comment