Electric Wheelchair Size

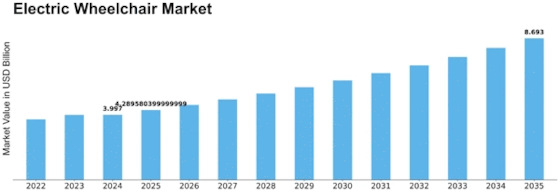

Electric Wheelchair Market Growth Projections and Opportunities

The increasing elderly population worldwide is driving the demand for electric wheelchairs as they offer mobility assistance to seniors with mobility impairments.

Technological Advancements : Ongoing technological innovations such as smart features, lightweight materials, and advanced battery technology are enhancing the functionality and convenience of electric wheelchairs, attracting more consumers.

Government Initiatives : Supportive government policies and initiatives aimed at improving accessibility and mobility for people with disabilities are fostering market growth by increasing affordability and availability of electric wheelchairs.

Growing Awareness : Heightened awareness about the benefits of electric wheelchairs among caregivers, healthcare professionals, and individuals with mobility limitations is expanding the consumer base and driving market expansion.

Urbanization and Infrastructure Development : Rapid urbanization and infrastructure development in emerging economies are increasing the need for assistive devices like electric wheelchairs to navigate urban environments, boosting market growth.

Healthcare Expenditure : Increasing healthcare expenditure, especially in developed regions, is facilitating greater access to electric wheelchairs through reimbursement programs and insurance coverage, thus driving market growth.

Demand for Enhanced Mobility Solutions : As consumers seek more efficient and comfortable mobility solutions, the demand for electric wheelchairs equipped with features like customizable seating, enhanced maneuverability, and extended battery life is on the rise.

Competitive Landscape : Intense competition among market players is driving continuous product development and innovation, resulting in a diverse range of electric wheelchair options catering to different user needs and preferences.

E-commerce Expansion : The proliferation of e-commerce platforms has made electric wheelchairs more accessible to consumers worldwide, offering a convenient purchasing channel and enabling greater market penetration.

Environmental Sustainability : Growing awareness of environmental sustainability is driving the adoption of eco-friendly electric wheelchair models with energy-efficient designs and recyclable materials, influencing consumer purchasing decisions.

Global Pandemic Impact : The COVID-19 pandemic has highlighted the importance of mobility aids like electric wheelchairs for vulnerable populations, leading to increased sales driven by healthcare facilities and individuals prioritizing safety and independence.

Consumer Preferences and Lifestyle Changes : Evolving consumer preferences, including a preference for active lifestyles and participation in social activities, are fueling the demand for electric wheelchairs that offer greater mobility and independence.

Regulatory Compliance : Adherence to stringent regulatory standards and safety certifications is crucial for market players to ensure product quality and consumer trust, shaping market dynamics and influencing purchasing decisions.

Collaborations and Partnerships : Collaborations between manufacturers, healthcare providers, and technology companies are facilitating the development of innovative electric wheelchair solutions and expanding market reach through distribution partnerships and strategic alliances.

Leave a Comment