North America : Innovation and Adoption Leader

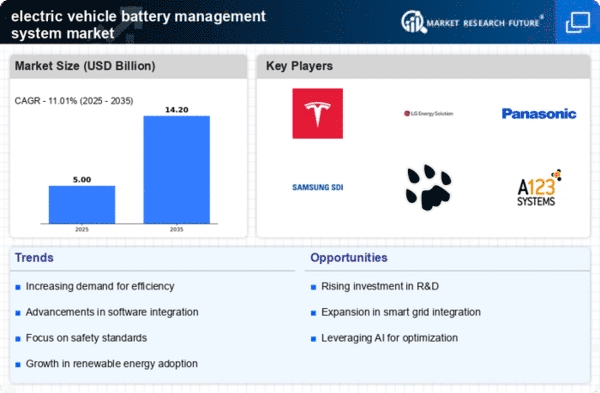

North America is witnessing robust growth in the electric vehicle (EV) battery management system market, driven by increasing consumer demand for sustainable transportation and supportive government policies. The market size is projected to reach $1.35 billion by December 2025, reflecting a significant share in the global landscape. Regulatory incentives, such as tax credits and emissions standards, are catalyzing investments in EV technologies, further propelling market expansion. The United States leads the region, with key players like Tesla and A123 Systems at the forefront of innovation. The competitive landscape is characterized by a mix of established automotive giants and emerging tech firms, all vying for market share. Collaborations and partnerships are common as companies seek to enhance battery efficiency and performance. The focus on research and development is expected to yield advanced battery management solutions, solidifying North America's position as a leader in the EV market.

Europe : Sustainability and Regulation Focus

Europe is rapidly transforming its electric vehicle (EV) battery management system market, with a projected size of $1.2 billion by December 2025. The region's growth is fueled by stringent environmental regulations and a strong commitment to reducing carbon emissions. Governments are implementing policies that promote EV adoption, including subsidies and infrastructure development, which are critical in driving market demand and innovation in battery technologies. Leading countries such as Germany, France, and the UK are at the forefront of this transformation, hosting major players like Bosch and LG Energy Solution. The competitive landscape is marked by significant investments in research and development, aimed at enhancing battery efficiency and sustainability. Collaborative efforts among automakers and technology firms are fostering innovation, positioning Europe as a key player in The electric vehicle battery management system market.

Asia-Pacific : Dominant Market Leader

Asia-Pacific is the largest market for electric vehicle (EV) battery management systems, with a market size of $2.4 billion projected by December 2025. The region's growth is driven by rapid urbanization, increasing disposable incomes, and a strong push towards sustainable transportation solutions. Government initiatives, such as subsidies for EV purchases and investments in charging infrastructure, are further enhancing market demand and adoption rates across countries. China, Japan, and South Korea are the leading countries in this market, with major players like CATL, Panasonic, and Samsung SDI dominating the landscape. The competitive environment is characterized by aggressive innovation and technological advancements, as companies strive to improve battery performance and reduce costs. The presence of a robust supply chain and manufacturing capabilities in the region supports the rapid growth of the EV battery management system market.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa (MEA) region is emerging as a potential market for electric vehicle (EV) battery management systems, with a projected size of $0.5 billion by December 2025. The growth is primarily driven by increasing awareness of environmental issues and the need for sustainable transportation solutions. Governments are beginning to recognize the importance of EVs, leading to the introduction of policies aimed at promoting electric mobility and reducing reliance on fossil fuels. Countries like South Africa and the UAE are taking the lead in adopting EV technologies, with investments in charging infrastructure and incentives for EV purchases. The competitive landscape is still developing, with a mix of local and international players entering the market. As the region continues to invest in renewable energy and sustainable practices, the demand for advanced battery management systems is expected to rise significantly.