Market Trends

Key Emerging Trends in the Electric Vehicle Battery Charger Market

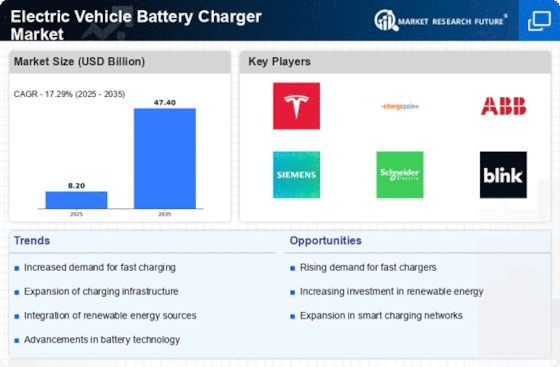

The worldwide electric vehicle battery charger market is segmented primarily based on electric-powered automobile type, degree of charging, utility, and place. Electric vehicle battery charger Market Size became worth USD five.7 billion in 2022. The EV Battery Charger market is projected to develop from USD 6.84 Billion in 2023 to USD 29.41 billion with the aid of 2032, displaying a compound annual growth rate (CAGR) of 20.00% at some point of the forecast duration (2023 - 2032). Based on electric automobile kind, the worldwide market has been segmented into battery electric powered automobiles and plug-in hybrid electric cars. On the premise of the level of charging, the worldwide market has been segmented into degree 1, stage 2, and degree 3. On the basis of application, the market has been segmented into public and Private electric vehicles (EVs.) The battery charger market is witnessing a dynamic shift in its landscape, pushed by the growing adoption of electric automobiles worldwide. One outstanding method entails product differentiation, where companies are aware of offering particular capabilities and current technology of their EV battery chargers. By doing so, they propose to distinguish their products from competition and capture the eye of discerning consumers. Another key factor of market proportion positioning within the Electric vehicle battery charger Market is pricing strategy. Some agencies opt for a fee leadership approach, aiming to provide chargers at a lower price factor in comparison to competitors. This approach aims to draw price-touchy purchasers and benefit an aggressive aspect in terms of affordability. On the opposite hand, top-rate pricing techniques that emphasize exceptional, advanced capabilities and superior performance are adopted by companies. These companies goal a gap market willing to pay a top class for pinnacle-notch charging solutions. Moreover, sustainability and environmental issues are shaping market percentage positioning techniques more and more within the electric vehicle battery charger market. Consumers are becoming more environmentally aware, and businesses are responding by emphasizing the eco-friendly factors of their products. Chargers with power-green capabilities, the usage of recycled materials, and a reduced carbon footprint are becoming key differentiators. In conclusion, the Electric vehicle battery charger Market is witnessing extreme competition, and market share positioning strategies are important for agencies aiming to thrive in this dynamic panorama. Product differentiation, pricing strategies, partnerships, geographic positioning, and a focal point on sustainability are all imperative components of a successful market proportion positioning.

Leave a Comment