Market Analysis

In-depth Analysis of Electric Vehicle Battery Charger Market Industry Landscape

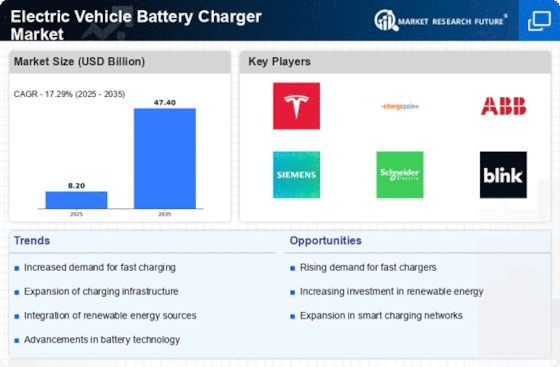

The demand for electric-powered car chargers increases throughout the assessment period due to the developing demand for electric motors. In most counties, the development of charging infrastructure and sales of electric cars is at a number one degree. The underdeveloped help infrastructure, lack of knowledge regarding electric automobiles, the excessive price of electric vehicles, and range tension are essential factors that can prevent the market size for the forecast duration. Hence, the worldwide key gamers' attention is on those important market restraints to improve their development and production procedure. Moreover, the authorities' cognizance of growing charging stations in numerous areas is anticipated to reinforce the adoption of electric cars on a large scale. All these projects are anticipated to increase the demand for electric car chargers and the Electric vehicle battery charger market during the forecast duration. Technological advancements are another important element influencing the market. Ongoing improvements in battery technology, such as improvements in energy density and charging pace, contribute to the general increase of the electric vehicle battery charger market. As battery technology evolves, the demand for more efficient and quicker chargers will increase, driving manufacturers to invest in studies and improvement to stay aggressive in the market. The car industry's dedication to electric-powered mobility is obvious in the increasing number of product services from major producers. The growing variety of electric-powered vehicle models available on the market necessitates various charging solutions and growing opportunities for charger manufacturers to cater to distinctive charging necessities. This variety in product offerings contributes to the general market enlargement, supplying clients with a range of selections based on their needs and preferences. Consumer conduct and attention also appreciably affect the market. As clients become more informed about the blessings of electric automobiles and charging infrastructure, they're more likely to make the switch from traditional cars. Manufacturers and policymakers play an essential position in instructing consumers about the advantages of electric vehicles and addressing worries associated with charging infrastructure accessibility and convenience. In the end, the Electric vehicle battery charger Market is influenced by a mixture of factors, starting from government guidelines and technological advancements to patron conduct and environmental issues. The market's trajectory is carefully tied to the wider tendencies within the electric-powered car enterprise, making it critical for stakeholders to live attuned to these factors to navigate the evolving landscape efficaciously.

Leave a Comment