Market Trends

Key Emerging Trends in the Electric Commercial Vehicle Market

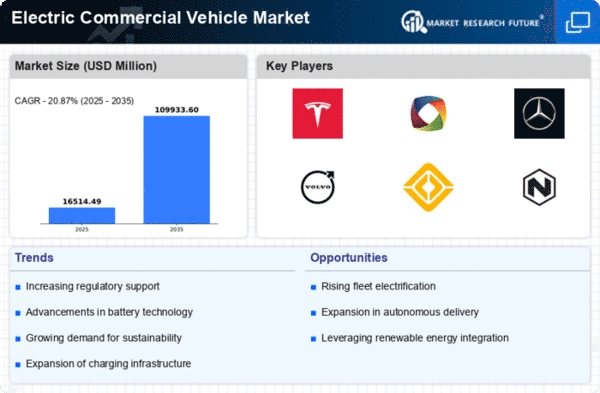

The electric commercial vehicle market is currently having a very high rate of growth and transformative trends outpaced by global sustainability shift heads toward sustainable transportation way. As environmental sustainability becomes more central to both personal and work life, companies are beginning to view even the inclusion of electric commercial vehicles as a part of their fleet policies. A key issue in the business sector is to minimise carbon emissions, follow government regulations and fulfil corporate ecological goals. All over the globe, governments have introduced strict emission standards and forced companies to consider electric counterparts. This regulatory climate has created greater emphasis on electric commercial vehicles because of their environmental benefits. Moreover, several fiscal incentives and subsidies offered by governments on electric vehicle adoption are also contributing to its growth. Such incentives not only have environmental benefits but also provide economic advantages by making electric commercial vehicles more profitable to businesses. The rising demand for electricity commercial vehicles is caused by the growth of e-commerce and last mile delivery services. There is also a growing need for quick and green delivery as online shopping continues to become more popular. In addition, the electric delivery vans and trucks are becoming increasingly popular as businesses seek to improve their logistics performance while simultaneously reducing environmental pollution. The trends of market are greatly influenced by technological progress. The challenges presented by electric commercial vehicles, such as the need for increased energy density and faster charging capabilities are partly being solved through continuous development of battery technology. As the battery technology progresses further allowing for longer driving ranges, range anxiety, a frequent worry in earlier stages of electric vehicle adoption recedes gradually. Smart and connected technologies integration is one of other notable trends in the electric commercial vehicle market. The use of live data and analysis in fleet management systems also facilitate optimal routing, vehicle tracking, as well as the minimization of operational costs. Apart from improving overall fleet efficiency, these technologies also lead to cost reduction in operational expenses. Indeed, collaborations and partnerships in the car industry have grown more common as businesses look to capitalize on each other’s strengths. Car manufacturers team up with technology firms and energy suppliers to develop full solutions that cover the whole range of electric vehicle environment. These partnerships enhance the charging infrastructure, battery technologies and promote market growth.

Leave a Comment