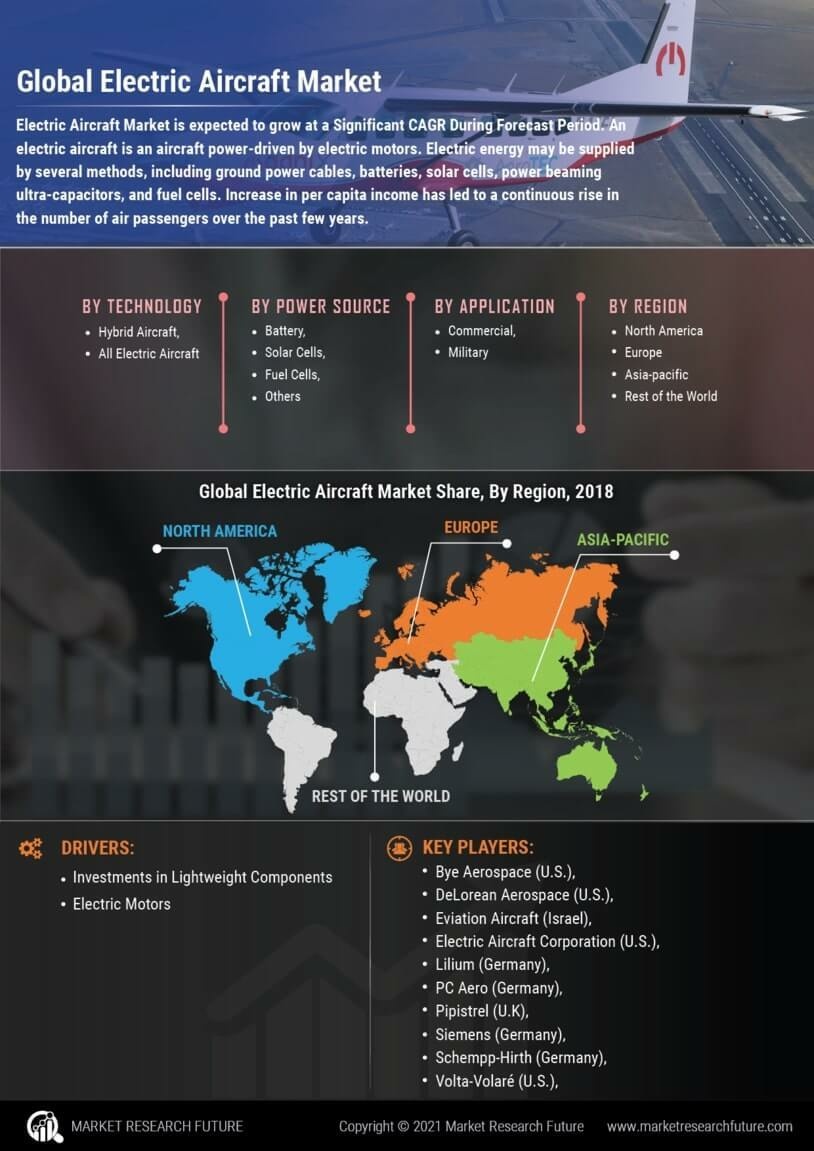

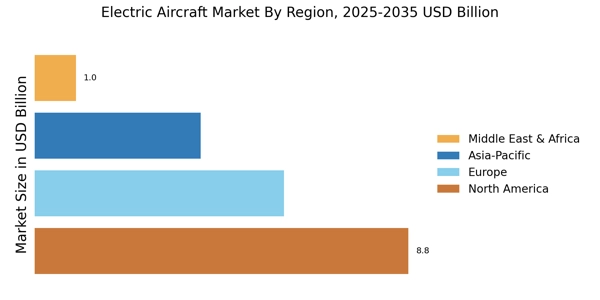

By Region, the study provides market insights into North America, Europe, Asia-Pacific and the Rest of the World. North America is predicted to increase rapidly during the projection period. Electric aircraft are increasingly being used for urban air travel in North America, and this aspect is projected to boost market expansion in this region. Many ecologically aware people are flying short distances in electric airplanes, which is driving up demand for the product.

Further, the major countries studied in the market report are The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Europe’s electric aircraft market accounts for the second-largest market share because of the growing market for electric aircraft and the region's strict restrictions for airplane emissions. Further, the German electric aircraft market held the largest market share and the UK electric aircraft Industry was the fastest-growing market in the European region

The Asia-Pacific Electric Aircraft Market is expected to grow at the fastest CAGR from 2023 to 2030. This is due to Renovating and enhancing the region's current aircraft infrastructure is necessary due to the increase in aviation traffic in the Asia-Pacific region. Moreover, China’s electric aircraft Industry held the largest market share, and the Indian electric aircraft market was the fastest-growing market in the Asia-Pacific region.

For instance, in December 202, The UK-based BAE Systems made a multi-million dollar facility investment to support its aircraft electrification activities in Endicott, America. The money will be used to fund the production of innovative control and power conversion system subsystems for use in aviation. Recent Market News

In October of 2024, Kempe Gowda International Airport in Bengaluru announced plans to deploy electric flying taxis in partnership with Sarla Aviation. The intention of the scheme was to launch seven-seater eVTOL aircraft that would be able to enable efficient and green transportation in short amounts of time, greatly revolutionizing the means of transportation in overcrowded metros.

In September 2024, the investigative sphere, Loganair, allied with Heart Aerospace aimed to add hybrid aircraft incorporation with an end four zero carbon emissions in 2040 while developing Heart's ES-30 aircraft. Furthermore, in a Series D funding round of $ 116 million five months later, ZeroAvia secured a follow-on investment of $ 34 million to expedite the research and expansion of a hydrogen-electric jet engine.

In September 2024, ZeroAvia raised USD 34 million in funding to advance the development and commercialization of hydrogen fuel cell and electric aircraft engines, building off the prior raise of USD 116 million.

In June 2024, magniX introduced an innovative battery system by the name of cc"Samson300" with an aim to advance electric and hybrid electric aviation systems including eVTOLs and helicopters.

In May 2024, Wilbur Air joined forces with FlyNow with the goal of deploying a hundred electric planes in Australia but commencing with freight operations. The focus of the commercial endeavor was to develop a business-to-business strategy that ensured the safety and security of operations prior to venturing into passenger transportation.

In May 2024, Ampaire Inc. completed the acquisition of the electric aviation technologist company Magpie Aviation Inc. The acquisition of the technology developed by Magpie is a competitive advantage for Ampaire, allowing it to maintain the lead in aviation electrification and respond to client needs with innovative solutions. The acquisition adds new technologies to Ampaire's IP and adds new contracts to its portfolio via Magpie's multiple pending patents and government contracts. With the acquisition, the company also expects to see renewed sales growth in its commercial and defense-focused sectors whilst improving its research and development capabilities.