Growing Investment in Drone Technology

Investment in drone technology is on the rise, significantly impacting the drone power source Market. Venture capital and government funding are increasingly directed towards drone startups and research initiatives, fostering innovation in power sources. For example, the total investment in drone technology reached approximately 1.5 billion dollars in 2025, reflecting a robust interest in enhancing drone capabilities. This influx of capital is likely to accelerate the development of advanced power systems, including hybrid and fuel cell technologies, which could revolutionize the operational efficiency of drones. As a result, the Drone Power Source Market is poised for substantial growth driven by these investments.

Regulatory Support for Drone Operations

Regulatory frameworks are evolving to support the integration of drones into various industries, thereby influencing the Drone Power Source Market. Governments are establishing guidelines that facilitate the safe operation of drones, which in turn drives the demand for reliable power sources. For instance, regulations that allow for beyond visual line of sight (BVLOS) operations necessitate drones with extended flight capabilities, placing greater emphasis on efficient power systems. This regulatory support is expected to enhance market growth, as companies seek to comply with new standards while optimizing their drone operations. Consequently, the Drone Power Source Market is likely to benefit from these favorable regulatory developments.

Technological Innovations in Energy Storage

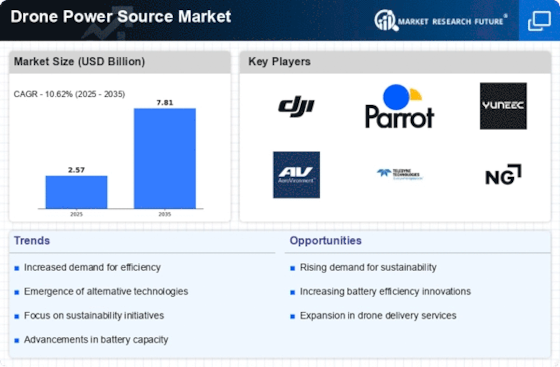

Technological advancements in energy storage systems are pivotal for the Drone Power Source Market. Innovations such as lithium-sulfur and solid-state batteries are emerging, offering higher energy densities and improved safety profiles compared to traditional lithium-ion batteries. These advancements are crucial as they enable drones to operate for extended periods, which is essential for applications like aerial surveying and emergency response. The market for energy storage solutions is expected to witness substantial growth, with projections indicating a compound annual growth rate of over 20% in the coming years. This trend underscores the importance of integrating cutting-edge energy storage technologies into the Drone Power Source Market.

Increased Demand for Drones in Various Sectors

The Drone Power Source Market experiences heightened demand due to the increasing utilization of drones across diverse sectors such as agriculture, logistics, and surveillance. As industries recognize the efficiency and cost-effectiveness of drone technology, the need for reliable power sources becomes paramount. For instance, the agricultural sector is projected to grow significantly, with drones being employed for crop monitoring and precision farming. This surge in demand necessitates advancements in power sources to ensure longer flight times and enhanced operational capabilities. Consequently, manufacturers are focusing on developing innovative power solutions that cater to the specific needs of various applications, thereby driving growth in the Drone Power Source Market.

Environmental Concerns Driving Sustainable Solutions

Environmental sustainability is becoming a critical focus, influencing the Drone Power Source Market. As concerns regarding carbon emissions and ecological impact grow, there is a push for cleaner energy solutions in drone operations. This trend is prompting manufacturers to explore alternative power sources, such as solar energy and biofuels, which could reduce the environmental footprint of drones. The market for sustainable power solutions is anticipated to expand, with projections indicating a significant increase in the adoption of eco-friendly technologies. This shift towards sustainability not only aligns with The Drone Power Source Industry as a leader in innovative energy solutions.