Top Industry Leaders in the DRAM Market

Competitive Landscape of DRAM Market:

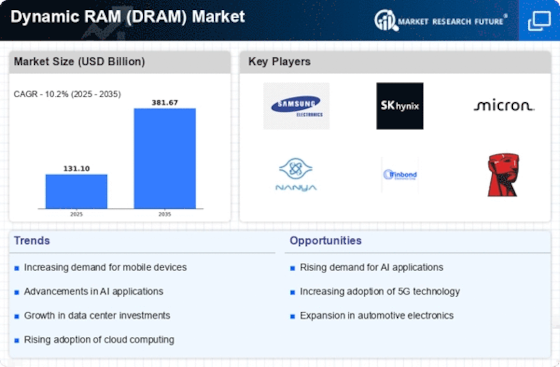

The Dynamic Random Access Memory (DRAM) market is a technology-driven and highly dynamic space, with a relatively small number of key players holding a significant majority of the market share. Understanding the competitive landscape is crucial for anyone involved in the industry, as it provides valuable insights into the strategies adopted by major players, the factors impacting market share distribution, the emergence of new competitors, and the overall competitive environment.

The competitive landscape of the DRAM market is expected to remain dynamic in the coming years. Established players will continue to invest in research and development, production capacity expansion, and acquisitions to maintain their dominance. However, new and emerging players are likely to gain traction by focusing on niche markets, offering cost-effective solutions, and forging strategic partnerships. This will lead to a more diversified and competitive market environment, ultimately benefiting consumers through improved product quality, lower prices, and faster innovation.

Some of the DRAM companies listed below:

- Samsung Electronics Co. Ltd.

- Winbond Electronics Corporation

- Nanya Technology Corporation

- ATP Electronics Inc.

- Micron Technology Inc.

- Integrated Silicon Solution Inc.

- SK Hynix Inc.

- Powerchip Technology Corporation

- Kingston Technology Corporation

- Transcend Information Inc.

Key Players and Strategies:

The DRAM market exhibits a moderate level of consolidation, with established players dominating a significant share. These giants prioritize technological advancements and invest heavily in research and development to remain at the forefront of innovation. They also focus on expanding production capacity and achieving economies of scale to maintain cost-competitiveness. Furthermore, mergers and acquisitions are considered strategic avenues for growth, as exemplified by the recent acquisition of Intel's NAND flash memory business by SK Hynix.

Factors for Market Share Analysis:

Several factors contribute to a company's market share in the DRAM market. Some of the key determinants include:

- Technology Leadership: The ability to develop and manufacture advanced DRAM technologies, such as high-density DRAM and low-power DRAM, provides a significant competitive advantage.

- Production Capacity and Scale: Having robust manufacturing capabilities and achieving economies of scale allows companies to offer competitive prices and meet market demand efficiently.

- Brand Reputation: A strong brand reputation built through consistent quality, reliability, and customer service fosters trust and loyalty, leading to increased market share.

- Financial Strength: Access to substantial financial resources allows companies to invest in research and development, production expansion, and strategic acquisitions, ultimately strengthening their market position.

- Distribution Network: Establishing a well-established distribution network ensures efficient and timely delivery of products to customers across various regions.

New and Emerging Companies:

While the DRAM market remains dominated by established players, some new and emerging companies are making their mark.

- Focus on Niche Markets: They often target specific segments of the market, such as high-performance computing or mobile DRAM, where they can exploit potential gaps left by larger players.

- Cost-Effective Production: They may utilize innovative production methods or source materials from cheaper regions to offer competitively priced products.

- Strategic Partnerships: They often collaborate with established players or technology companies to leverage expertise and gain access to resources and markets.

The DRAM market presents a complex and dynamic competitive landscape. Understanding the key players, their strategies, and the factors influencing market share is crucial for navigating this market successfully. As technology continues to evolve, new opportunities and challenges will emerge, shaping the future of the DRAM industry.

Latest Company Updates:

June 2023- Realme Malaysia has recently introduced the Realme C53. This latest entry-level smartphone is available for sale from 7th June 2023. It will come with a single variant- 128GN + 6GB with up to 12GB DRAM (dynamic RAM). The phone also comes with a 33W SuperVOOC charge that is the foremost in this series for 5000mAh battery & is powered via a T612 octa-core chipset via Unisoc. Besides, the C53 supports 1 MicroSD card and 2 Nano SIM cards simultaneously with 2 TB of additional space. The Realme C53 had undergone six quality assurance standards for ensuring this will function well for years ahead including drop tests, battery tests, other hardware tests & also extreme environment and safety tests.

May 2023- Realme Narzo N53 has been recently launched in India. As per the metadata from the official website, this smartphone comes with a 16GB dynamic RAM as well as 33W fast charging support. The mobile phone company also teased their ever slimmest smartphone on Amazon India & the source code also revealed that this is the Narzo N53. The best part is as per report, the latest addition from Realme, the Realme Narzo N53 comes with 5G connectivity support. This handset comes in two beautiful shades of Feather Gold and Feather Black. Besides, this phone is available in two variants- 6GB + 128GB and 4GB + 64 GB. It has a 50MP main camera and an 8MP front camera. The front camera comes with a Mini Capsule that shows notifications about data usage, steps taken, and charging status.