Growth in Food and Beverage Sector

The Double Diaphragm Pumps Market is witnessing growth fueled by the food and beverage sector's increasing demand for hygienic and efficient pumping solutions. As food safety regulations become more stringent, manufacturers are turning to double diaphragm pumps for their ability to maintain product integrity while ensuring compliance with health standards. The market data suggests that this sector is expanding, with a notable increase in the adoption of these pumps for transferring various food products, including viscous liquids and slurries. This trend highlights the importance of the Double Diaphragm Pumps Market in supporting the food and beverage industry's evolving needs.

Rising Demand in Chemical Processing

The Double Diaphragm Pumps Market experiences a notable surge in demand, particularly within the chemical processing sector. This growth is driven by the need for efficient and reliable fluid transfer solutions that can handle corrosive and viscous materials. As industries increasingly prioritize safety and efficiency, double diaphragm pumps are favored for their ability to operate under varying pressures and flow rates. Recent data indicates that the chemical processing segment accounts for a substantial share of the market, reflecting a trend towards automation and enhanced operational efficiency. The versatility of these pumps in handling different types of fluids further solidifies their position in this sector, suggesting a robust future for the Double Diaphragm Pumps Market.

Expansion in Water and Wastewater Management

The Double Diaphragm Pumps Market is significantly influenced by the expansion of water and wastewater management initiatives. As urbanization accelerates, the demand for effective water treatment solutions rises, necessitating reliable pumping systems. Double diaphragm pumps are increasingly utilized in these applications due to their ability to handle slurries and solids without clogging. Market data reveals that the water and wastewater management sector is projected to grow, driven by regulatory pressures and the need for sustainable practices. This trend indicates a promising outlook for the Double Diaphragm Pumps Market, as municipalities and industries seek efficient solutions to manage water resources effectively.

Technological Innovations Enhancing Performance

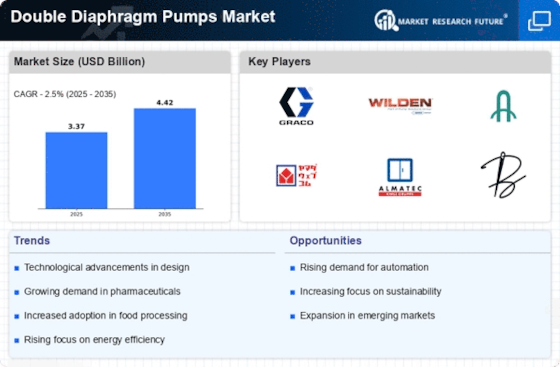

The Double Diaphragm Pumps Market is significantly impacted by ongoing technological innovations that enhance pump performance and efficiency. Manufacturers are investing in research and development to create pumps that offer improved durability, energy efficiency, and ease of maintenance. Recent advancements include the integration of smart technologies that allow for real-time monitoring and control of pump operations. This trend is likely to attract new customers and retain existing ones, as industries seek to optimize their processes. The data suggests that these innovations are driving growth in the Double Diaphragm Pumps Market, positioning it favorably for future expansion.

Increased Adoption in Pharmaceutical Applications

The Double Diaphragm Pumps Market is experiencing heightened adoption within the pharmaceutical sector, driven by the need for precise and sterile fluid handling. Pharmaceutical manufacturers require pumps that can ensure the integrity of sensitive compounds while minimizing contamination risks. Double diaphragm pumps are increasingly recognized for their ability to provide accurate flow rates and handle a variety of fluids, including those with high viscosity. Market analysis indicates that the pharmaceutical industry is expanding, leading to a greater reliance on advanced pumping technologies. This trend underscores the critical role of the Double Diaphragm Pumps Market in meeting the stringent demands of pharmaceutical applications.