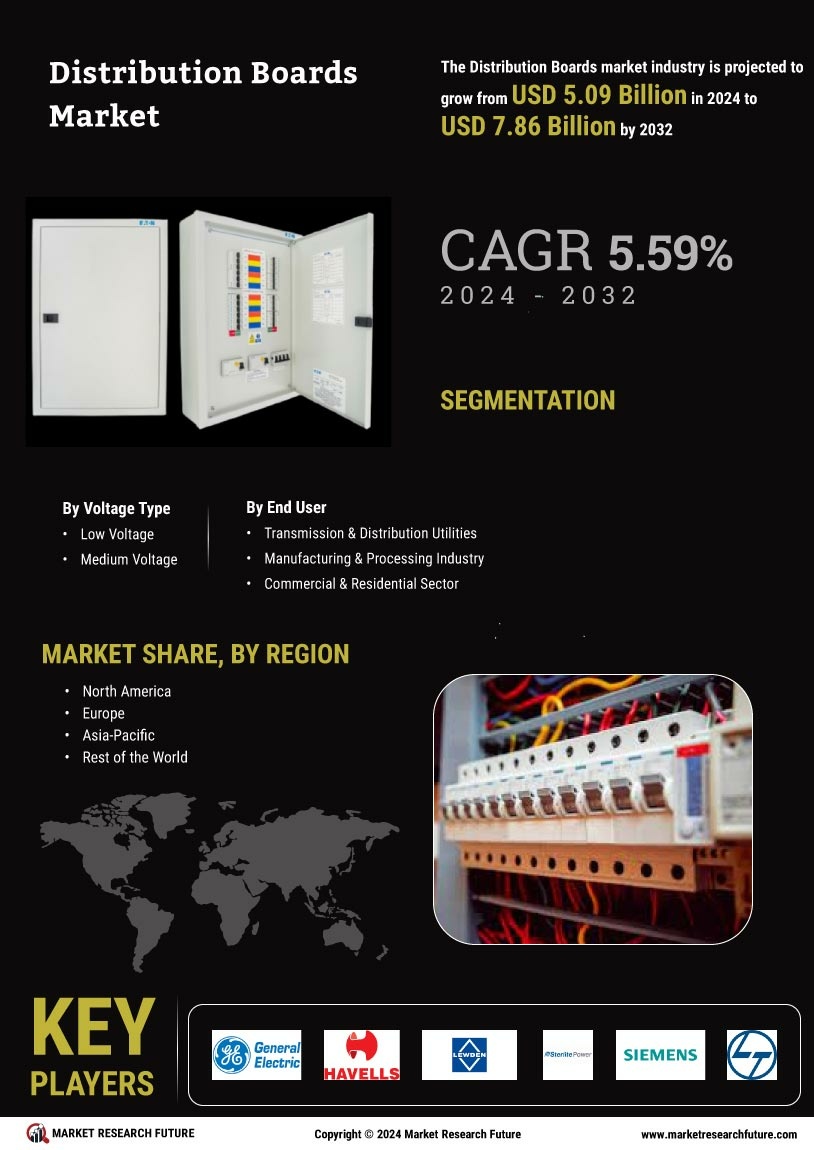

Distribution Boards Market Summary

As per Market Research Future analysis, the Distribution Boards Market Size was estimated at 5.09 USD Billion in 2024. The Distribution Boards industry is projected to grow from 5.375 USD Billion in 2025 to 9.261 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.59% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Distribution Boards Market is experiencing robust growth driven by technological advancements and sustainability initiatives.

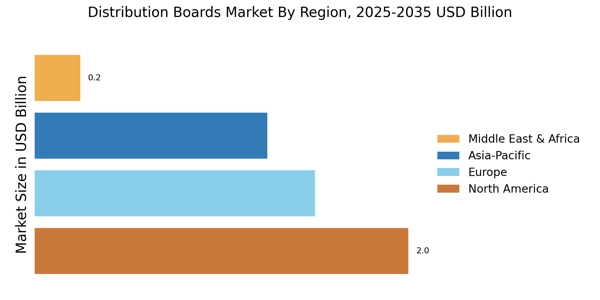

- Technological advancements are enhancing the efficiency and functionality of distribution boards, particularly in North America.

- Sustainability initiatives are increasingly influencing market dynamics, with a notable rise in demand for eco-friendly solutions in the Asia-Pacific region.

- The low voltage segment remains the largest, while the medium voltage segment is witnessing the fastest growth due to evolving industry needs.

- Key market drivers include technological advancements in distribution boards and the integration of renewable energy sources, which are shaping future demand.

Market Size & Forecast

| 2024 Market Size | 5.09 (USD Billion) |

| 2035 Market Size | 9.261 (USD Billion) |

| CAGR (2025 - 2035) | 5.59% |

Major Players

Schneider Electric (FR), Siemens (DE), Eaton (US), ABB (CH), Legrand (FR), General Electric (US), Mitsubishi Electric (JP), Honeywell (US), Rockwell Automation (US)