Increased Focus on Safety and Security

Safety and security concerns are propelling the Distributed Fiber Optic Sensor Market forward. Industries such as oil and gas, transportation, and utilities are increasingly adopting fiber optic sensors to monitor critical assets and detect potential threats. These sensors can identify changes in temperature, pressure, and strain, which are vital for preventing accidents and ensuring operational continuity. The market is expected to witness substantial growth as organizations prioritize safety measures. The integration of fiber optic sensors into security systems not only enhances monitoring capabilities but also provides a proactive approach to risk management, thereby driving market expansion.

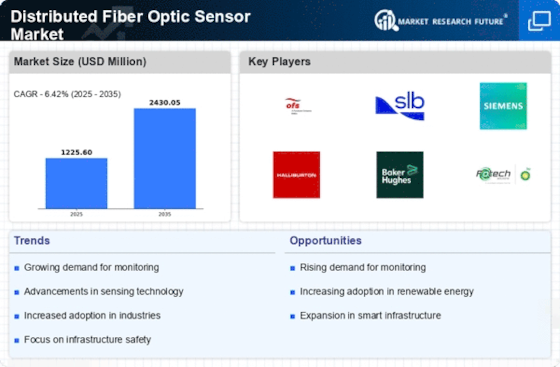

Rising Demand for Infrastructure Monitoring

The Distributed Fiber Optic Sensor Market is experiencing a surge in demand driven by the need for effective infrastructure monitoring. As urbanization accelerates, the integrity of structures such as bridges, tunnels, and pipelines becomes paramount. Fiber optic sensors provide real-time data on structural health, enabling timely maintenance and reducing the risk of catastrophic failures. According to recent estimates, the market for infrastructure monitoring is projected to grow significantly, with fiber optic solutions playing a crucial role. This trend is likely to enhance the adoption of distributed fiber optic sensors, as stakeholders seek reliable and efficient monitoring solutions to ensure safety and longevity of critical infrastructure.

Growing Adoption in Environmental Monitoring

The Distributed Fiber Optic Sensor Market is witnessing a growing adoption in environmental monitoring applications. As concerns about climate change and environmental degradation intensify, there is an increasing need for effective monitoring solutions. Fiber optic sensors are capable of providing real-time data on various environmental parameters, such as temperature, humidity, and soil moisture. This capability is particularly valuable for applications in agriculture, water management, and natural disaster monitoring. The market is projected to expand as more organizations leverage fiber optic technology to enhance their environmental monitoring efforts, thereby contributing to sustainability initiatives.

Expansion of Telecommunications Infrastructure

The expansion of telecommunications infrastructure is a key driver for the Distributed Fiber Optic Sensor Market. With the increasing demand for high-speed internet and data transmission, fiber optic technology is becoming essential for modern communication networks. Distributed fiber optic sensors are being integrated into telecommunications systems to monitor network performance and detect faults. This integration not only enhances the reliability of communication networks but also supports the growing need for data-driven solutions. As telecommunications infrastructure continues to evolve, the demand for distributed fiber optic sensors is expected to rise, further solidifying their role in the industry.

Technological Advancements in Sensing Solutions

Technological advancements are significantly influencing the Distributed Fiber Optic Sensor Market. Innovations in sensor technology, such as improved sensitivity and miniaturization, are enhancing the performance and applicability of fiber optic sensors. These advancements enable more precise measurements and broaden the scope of applications, from environmental monitoring to industrial automation. The market is likely to benefit from ongoing research and development efforts aimed at creating next-generation sensing solutions. As industries increasingly recognize the advantages of fiber optic technology, the demand for advanced sensing solutions is expected to rise, further propelling market growth.