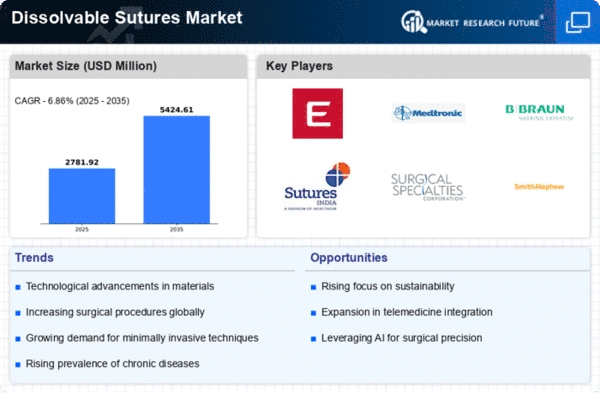

Market Growth Projections

The Global Dissolvable Sutures Market Industry is projected to experience substantial growth over the coming years. With a market value anticipated to reach 3.6 USD Billion in 2024 and potentially grow to 6.99 USD Billion by 2035, the industry is on a promising trajectory. The compound annual growth rate of 6.21% from 2025 to 2035 indicates a robust expansion driven by various factors, including technological advancements, increasing surgical procedures, and heightened awareness of patient safety. These projections reflect the dynamic nature of the market and its responsiveness to evolving healthcare demands.

Increasing Prevalence of Chronic Diseases

The Global Dissolvable Sutures Market Industry is significantly influenced by the rising prevalence of chronic diseases, which often necessitate surgical interventions. Conditions such as diabetes, cardiovascular diseases, and obesity require surgical procedures that utilize effective suturing solutions. As the global population ages and the incidence of these diseases rises, the demand for dissolvable sutures is expected to grow. This trend is further supported by the projected compound annual growth rate of 6.21% from 2025 to 2035, indicating a robust market response to the increasing healthcare needs associated with chronic conditions.

Rising Demand for Minimally Invasive Surgeries

The Global Dissolvable Sutures Market Industry is experiencing a notable increase in demand for minimally invasive surgical procedures. These techniques are preferred due to their reduced recovery times and lower risk of complications. As healthcare providers increasingly adopt these methods, the need for effective suturing solutions becomes paramount. Dissolvable sutures, which eliminate the need for removal, align well with the requirements of such procedures. This trend is expected to contribute significantly to the market, with projections indicating a market value of 3.6 USD Billion in 2024, reflecting the growing preference for patient-centric surgical options.

Technological Advancements in Suture Materials

Innovations in suture technology are driving growth within the Global Dissolvable Sutures Market Industry. The development of advanced materials, such as synthetic polymers and bioengineered products, enhances the performance and biocompatibility of dissolvable sutures. These advancements not only improve healing times but also reduce the risk of infection and adverse reactions. As healthcare facilities increasingly prioritize the use of high-quality sutures, the market is likely to expand. The anticipated growth trajectory suggests that by 2035, the market could reach approximately 6.99 USD Billion, underscoring the impact of technological progress on surgical practices.

Growing Awareness of Patient Safety and Comfort

There is a growing emphasis on patient safety and comfort within the Global Dissolvable Sutures Market Industry. Healthcare providers are increasingly recognizing the importance of minimizing patient discomfort and enhancing recovery experiences. Dissolvable sutures, which do not require removal, contribute to this goal by reducing the need for additional procedures and potential complications. As patient-centric care becomes a priority, the adoption of dissolvable sutures is likely to increase. This shift in focus may lead to a more favorable market environment, as healthcare institutions strive to improve patient outcomes and satisfaction.

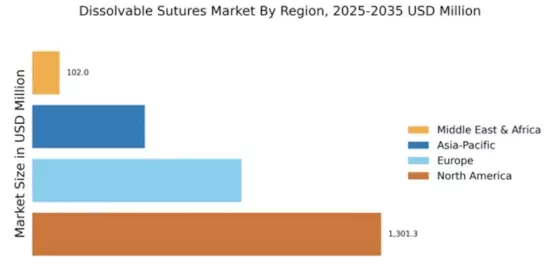

Expansion of Surgical Procedures in Emerging Markets

The Global Dissolvable Sutures Market Industry is poised for growth due to the expansion of surgical procedures in emerging markets. As healthcare infrastructure improves and access to surgical care increases in regions such as Asia-Pacific and Latin America, the demand for effective suturing solutions rises. Dissolvable sutures are particularly appealing in these markets due to their ease of use and reduced need for follow-up care. This trend is expected to contribute to the overall market growth, as more healthcare facilities adopt dissolvable sutures to meet the needs of their patient populations.