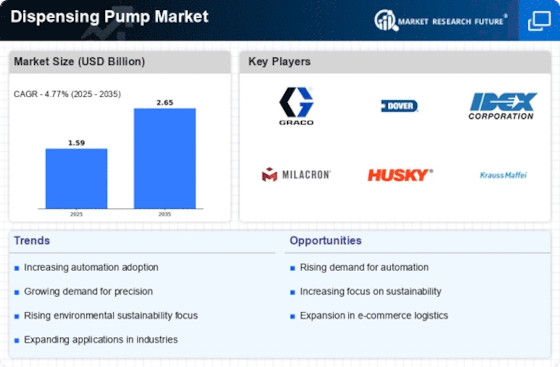

Increased Focus on Automation

The trend towards automation across various industries is a significant driver of the Dispensing Pump Market. As companies seek to enhance operational efficiency and reduce labor costs, automated dispensing systems are becoming increasingly prevalent. Industries such as pharmaceuticals, cosmetics, and chemicals are adopting these systems to streamline production processes. Data suggests that the automation segment within the dispensing pump market is expected to witness a growth rate of approximately 7% in the coming years. This shift not only improves accuracy and reduces waste but also aligns with the broader industry trend of integrating smart technologies into manufacturing processes, thereby fostering innovation and competitiveness.

Rising Demand in Healthcare Sector

The healthcare sector's increasing demand for precise and efficient fluid dispensing solutions significantly drives the Dispensing Pump Market. Hospitals and clinics require reliable dispensing pumps for administering medications, vaccines, and other fluids. According to recent data, the healthcare segment accounts for a substantial share of the market, with projections indicating a growth rate of approximately 6% annually. This trend is likely to continue as healthcare facilities prioritize patient safety and treatment efficacy, necessitating advanced dispensing technologies. Furthermore, the rise in chronic diseases and the aging population contribute to the heightened need for sophisticated dispensing systems, thereby enhancing the overall market landscape.

Growth in Food and Beverage Industry

The food and beverage industry plays a pivotal role in propelling the Dispensing Pump Market forward. As consumer preferences shift towards convenience and quality, manufacturers are increasingly adopting dispensing pumps for accurate portion control and enhanced product consistency. The market for food and beverage dispensing pumps is projected to grow at a compound annual growth rate of around 5% over the next few years. This growth is attributed to the rising demand for packaged and processed foods, which require efficient dispensing solutions to maintain product integrity. Additionally, innovations in pump technology, such as hygienic designs and easy cleaning features, further support the expansion of this market segment.

Technological Innovations in Pump Design

Technological innovations in pump design are significantly influencing the Dispensing Pump Market. Advances in materials, control systems, and design methodologies are leading to the development of more efficient and reliable dispensing pumps. For instance, the introduction of smart pumps equipped with IoT capabilities allows for real-time monitoring and data collection, enhancing operational efficiency. The market is expected to grow at a rate of approximately 5% as these innovations become more mainstream. Furthermore, the integration of user-friendly interfaces and enhanced safety features is likely to attract a broader customer base, thereby driving market expansion and fostering competition among manufacturers.

Environmental Regulations and Sustainability

The growing emphasis on environmental regulations and sustainability initiatives is reshaping the Dispensing Pump Market. Companies are increasingly required to adopt eco-friendly practices, leading to a surge in demand for sustainable dispensing solutions. This includes the development of pumps that minimize waste and utilize recyclable materials. Recent statistics indicate that the market for environmentally friendly dispensing pumps is expanding, with a projected growth rate of around 4% annually. As consumers become more environmentally conscious, manufacturers are responding by innovating products that align with sustainability goals, thus enhancing their market position and meeting regulatory requirements.