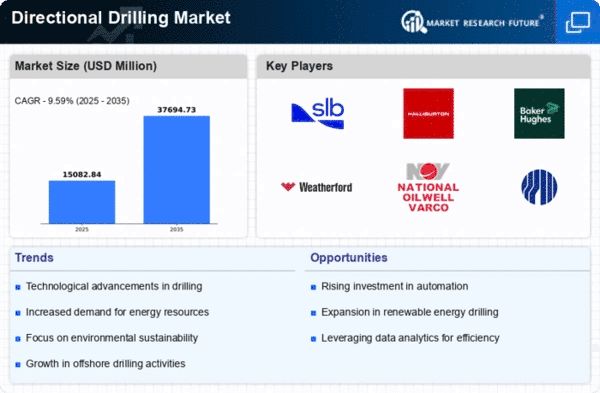

Market Growth Projections

The Global Directional Drilling Market Industry is poised for substantial growth, with projections indicating a market size of 13.8 USD Billion in 2024 and an anticipated increase to 41.3 USD Billion by 2035. This growth trajectory, characterized by a compound annual growth rate of 10.45% from 2025 to 2035, reflects the industry's resilience and adaptability. Factors such as technological advancements, regulatory support, and rising energy demands contribute to this optimistic outlook. The market's expansion is likely to attract investments and innovations, further solidifying its position in the global energy landscape.

Increasing Demand for Energy Resources

The Global Directional Drilling Market Industry experiences heightened demand for energy resources, driven by the need for efficient extraction methods. As global energy consumption rises, directional drilling techniques facilitate access to hard-to-reach reserves, particularly in oil and gas sectors. In 2024, the market is projected to reach 13.8 USD Billion, reflecting the industry's response to energy demands. Countries with significant reserves, such as the United States and Saudi Arabia, are increasingly adopting these technologies to enhance production efficiency. This trend suggests that the Global Directional Drilling Market Industry will continue to evolve, adapting to the growing energy needs of various economies.

Growing Focus on Oil and Gas Exploration

The Global Directional Drilling Market Industry is significantly influenced by the growing focus on oil and gas exploration. As traditional reserves deplete, companies are increasingly turning to unconventional sources, necessitating advanced drilling techniques. Directional drilling allows for the efficient extraction of oil and gas from complex geological formations, thereby enhancing recovery rates. This shift in exploration strategies is likely to drive market growth, as firms seek to maximize their resource potential. The industry's evolution in response to exploration demands suggests a robust future, with directional drilling becoming a cornerstone of modern energy strategies.

Regulatory Support for Sustainable Practices

The Global Directional Drilling Market Industry benefits from increasing regulatory support aimed at promoting sustainable drilling practices. Governments worldwide are implementing policies that encourage the adoption of environmentally friendly technologies. This regulatory framework not only fosters innovation but also enhances the industry's reputation. For instance, initiatives that incentivize reduced emissions and waste management are likely to attract investments in directional drilling. As a result, companies that align with these regulations may experience a competitive advantage, further propelling market growth. The industry's adaptability to regulatory changes suggests a promising future in the context of sustainability.

Rising Investments in Infrastructure Development

Rising investments in infrastructure development significantly impact the Global Directional Drilling Market Industry. As nations expand their energy infrastructure, the demand for efficient drilling solutions increases. Major projects, particularly in emerging economies, require advanced drilling techniques to optimize resource extraction. For example, countries in Asia and Africa are ramping up investments in energy infrastructure, which could lead to a surge in directional drilling activities. This trend indicates a potential market expansion, with projections suggesting that the industry could reach 41.3 USD Billion by 2035. The interplay between infrastructure development and directional drilling is likely to shape future market dynamics.

Technological Advancements in Drilling Equipment

Technological innovations play a pivotal role in shaping the Global Directional Drilling Market Industry. The introduction of advanced drilling equipment and techniques enhances precision and reduces operational costs. Innovations such as rotary steerable systems and real-time data analytics improve drilling efficiency and safety. As these technologies become more accessible, companies are likely to invest in upgrading their equipment, thereby driving market growth. The anticipated compound annual growth rate of 10.45% from 2025 to 2035 indicates a robust trajectory for the industry, as firms seek to leverage these advancements to optimize their drilling operations.