Market Share

Digital Workspace Market Share Analysis

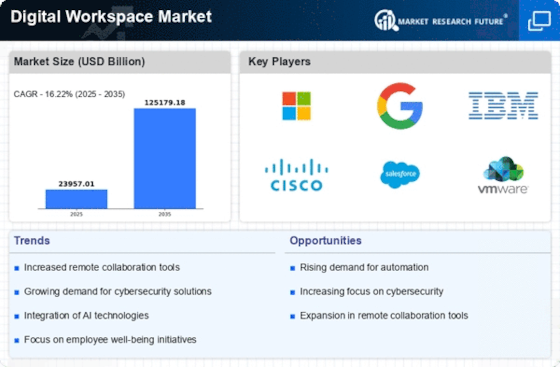

The digital workspace market is witnessing exponential growth driven by the increasing adoption of remote work, cloud computing, and digital transformation initiatives across organizations worldwide. As businesses strive to enhance productivity, collaboration, and employee experience, the demand for digital workspace solutions continues to surge. In this competitive landscape, companies deploy various market share positioning strategies to differentiate themselves and gain a competitive edge.

One of the primary strategies employed by companies in the digital workspace market is product innovation. With the evolving needs of modern businesses and the proliferation of digital technologies, companies invest heavily in research and development to introduce innovative workspace solutions. This includes integrated platforms that encompass virtual desktop infrastructure (VDI), unified communication and collaboration tools, mobility solutions, and secure access technologies. By offering comprehensive and user-centric digital workspace solutions, companies can differentiate their products and address the diverse needs of customers across industries.

Moreover, strategic partnerships and collaborations play a crucial role in market share positioning within the digital workspace market. Companies often form alliances with technology providers, system integrators, and industry-specific solution vendors to enhance their product offerings and expand their market reach. Collaborative efforts enable companies to leverage partner expertise, integrate complementary technologies, and deliver end-to-end solutions that meet the unique requirements of customers. By aligning with key stakeholders in the ecosystem, companies can strengthen their competitive position and offer differentiated value propositions to customers.

Furthermore, effective marketing and branding strategies are essential for companies seeking to enhance their market share in the digital workspace market. Building a strong brand reputation and establishing thought leadership are critical for gaining customer trust and credibility. Companies invest in targeted marketing campaigns, content marketing initiatives, and participation in industry events to raise awareness about their digital workspace solutions and showcase their expertise. By positioning themselves as trusted advisors and solution providers, companies can differentiate their offerings and attract the attention of potential customers.

In addition to product innovation and strategic partnerships, pricing strategies play a significant role in market share positioning within the digital workspace market. Price sensitivity is a key consideration for customers, particularly in the current economic climate. Companies adopt various pricing strategies such as value-based pricing, subscription models, and flexible licensing options to attract customers and gain market share. While maintaining profitability is important, companies may offer discounts, promotions, and bundled packages to incentivize purchase decisions and gain a competitive edge.

Moreover, a strong focus on customer experience and support is essential for companies looking to enhance their market share in the digital workspace market. Providing seamless onboarding, personalized training, and responsive technical assistance can enhance customer satisfaction and loyalty. Companies that prioritize customer-centricity differentiate themselves from competitors and build long-term relationships with customers. By offering ongoing support and proactive maintenance services, companies can ensure the continued success and adoption of their digital workspace solutions.

Furthermore, geographical expansion and market diversification are key strategies employed by companies to increase their market share in the digital workspace market. By targeting new geographic regions, industry verticals, and customer segments, companies can tap into unexplored opportunities and reduce dependency on specific markets. Expanding product portfolios to include specialized solutions for vertical-specific use cases such as healthcare, finance, and education also enables companies to address evolving customer needs and capture a larger share of the market.

Leave a Comment