Rising Water Scarcity

The increasing prevalence of water scarcity is a critical driver for the Digital Water Solutions Market. As populations grow and climate change exacerbates water shortages, the demand for efficient water management solutions intensifies. According to recent estimates, nearly 2 billion people currently live in water-stressed areas, which is likely to increase. Digital water solutions, such as smart metering and real-time monitoring systems, provide utilities with the tools necessary to optimize water distribution and reduce waste. This trend indicates a shift towards adopting advanced technologies that can enhance water conservation efforts, thereby propelling the Digital Water Solutions Market forward.

Technological Advancements

Technological advancements in the field of water management are driving the Digital Water Solutions Market. Innovations such as artificial intelligence, machine learning, and advanced data analytics are enabling utilities to enhance operational efficiency and decision-making processes. The integration of these technologies allows for predictive maintenance, which can reduce downtime and operational costs. As utilities increasingly recognize the value of data-driven insights, the market for digital water solutions is expected to expand. Recent projections suggest that the adoption of these technologies could lead to a market growth rate of approximately 12% annually, underscoring the importance of technological evolution in the Digital Water Solutions Market.

Government Regulations and Policies

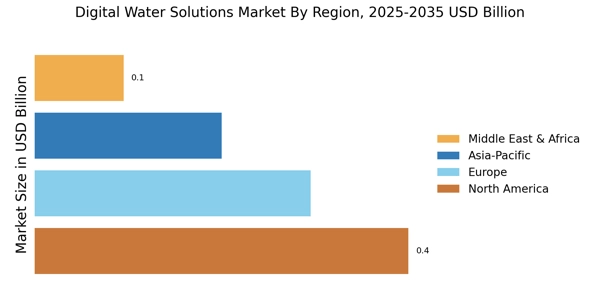

Government regulations aimed at improving water quality and management are significantly influencing the Digital Water Solutions Market. Many countries are implementing stricter standards for water usage and wastewater treatment, which necessitates the adoption of digital solutions. For instance, regulations mandating the reduction of water loss in distribution systems are prompting utilities to invest in smart technologies. The market for digital water solutions is projected to grow as municipalities seek compliance with these regulations, which could lead to an estimated increase in market size by 15% over the next five years. This regulatory environment fosters innovation and investment in the Digital Water Solutions Market.

Increased Investment in Smart Infrastructure

The growing investment in smart infrastructure is a pivotal driver for the Digital Water Solutions Market. As cities evolve and urbanization accelerates, there is a pressing need for modernized water systems that can efficiently manage resources. Investments in smart water grids and automated systems are becoming more prevalent, as they offer enhanced monitoring and control capabilities. This trend is reflected in the projected market growth, which is anticipated to reach USD 30 billion by 2027. The emphasis on smart infrastructure not only improves service delivery but also aligns with sustainability goals, thereby reinforcing the relevance of the Digital Water Solutions Market.

Consumer Awareness and Demand for Transparency

Consumer awareness regarding water quality and sustainability is increasingly influencing the Digital Water Solutions Market. As individuals become more informed about the implications of water usage and management, there is a growing demand for transparency in water services. Utilities are responding by adopting digital solutions that provide real-time data on water quality and usage patterns. This shift towards transparency is likely to enhance customer engagement and trust, which can lead to increased adoption of digital water solutions. Market analysts suggest that this trend could contribute to a 10% increase in market penetration for digital solutions in the coming years, highlighting the importance of consumer-driven change in the Digital Water Solutions Market.