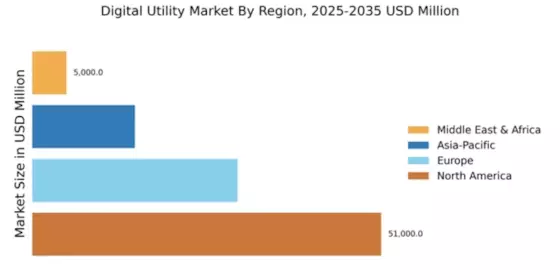

North America : Innovation and Leadership Hub

North America leads the Digital Utility Market with a substantial share of 51,000.0. The region's growth is driven by increasing investments in smart grid technologies, renewable energy integration, and regulatory support for digital transformation. The demand for efficient energy management solutions is rising, fueled by sustainability goals and technological advancements. Regulatory frameworks are evolving to support innovation, enhancing market dynamics. The competitive landscape is robust, with the US being a key player, hosting major companies like General Electric, IBM, and Honeywell. These firms are at the forefront of digital utility innovations, leveraging IoT and AI to optimize energy distribution and consumption. The presence of established players fosters a vibrant ecosystem, encouraging startups and new entrants to innovate and contribute to market growth.

Europe : Sustainable Energy Transition Leader

Europe's Digital Utility Market is valued at 30,000.0, reflecting a strong commitment to sustainability and digital transformation. The region is witnessing a surge in demand for smart energy solutions, driven by stringent EU regulations aimed at reducing carbon emissions and enhancing energy efficiency. Initiatives like the European Green Deal are pivotal in shaping market dynamics, promoting investments in digital infrastructure and renewable energy sources. Leading countries such as Germany, France, and the UK are spearheading this transition, with significant contributions from companies like Siemens and Schneider Electric. The competitive landscape is characterized by innovation and collaboration, as firms partner with governments and research institutions to develop cutting-edge technologies. This collaborative approach is essential for meeting the region's ambitious energy targets and fostering a resilient digital utility ecosystem.

Asia-Pacific : Emerging Market with Potential

The Asia-Pacific region, valued at 15,000.0, is rapidly emerging as a significant player in the Digital Utility Market. The growth is propelled by urbanization, increasing energy demands, and government initiatives promoting smart grid technologies. Countries like China and India are investing heavily in digital infrastructure to enhance energy efficiency and reliability. Regulatory support is crucial, as governments aim to modernize their energy sectors and integrate renewable sources. China leads the region, with substantial investments from state-owned enterprises and private players in digital utility solutions. The competitive landscape is evolving, with local firms collaborating with global giants like ABB and Cisco to innovate and expand their offerings. This collaboration is vital for addressing the unique challenges of the region, including energy access and sustainability goals.

Middle East and Africa : Resource-Rich Yet Developing Market

The Middle East and Africa (MEA) region, valued at 5,000.0, is at a pivotal stage in the Digital Utility Market. The growth is driven by increasing energy demands, urbanization, and a push towards digital transformation in utility services. Governments are recognizing the importance of modernizing their energy sectors, leading to investments in smart grid technologies and renewable energy projects. Regulatory frameworks are gradually evolving to support these initiatives, fostering a conducive environment for growth. Countries like the UAE and South Africa are leading the charge, with significant investments in digital utility solutions. The competitive landscape is characterized by a mix of local and international players, including firms like Honeywell and Oracle. This diversity fosters innovation and collaboration, essential for overcoming the region's unique challenges, such as energy access and sustainability.