North America : Market Leader in Innovation

North America continues to lead the Digital Payment Solutions Consulting Services Market, holding a significant market share of 16.25 in 2024. The region's growth is driven by increasing consumer demand for seamless payment experiences, advancements in technology, and supportive regulatory frameworks. The rise of e-commerce and mobile payments has further accelerated this trend, making digital payment solutions essential for businesses aiming to enhance customer engagement and operational efficiency.

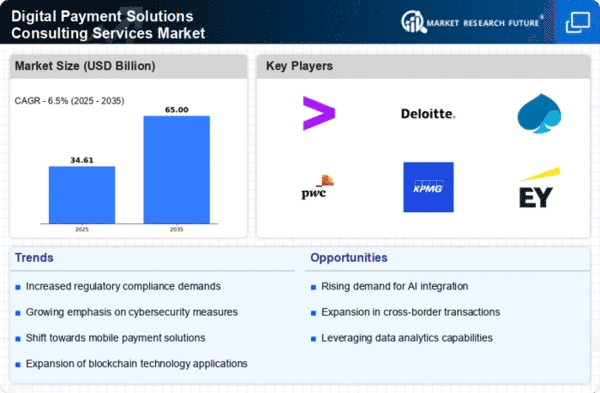

The competitive landscape in North America is robust, featuring key players such as Accenture, Deloitte, and PwC. The U.S. stands out as the largest market, driven by a tech-savvy population and high internet penetration. Companies are investing heavily in innovative solutions to stay ahead, focusing on security, user experience, and integration capabilities. This dynamic environment fosters continuous improvement and adaptation to emerging trends, ensuring North America remains at the forefront of digital payment solutions.

Europe : Emerging Market with Potential

Europe's Digital Payment Solutions Consulting Services Market is poised for growth, with a market size of 8.5 in 2024. The region benefits from a strong regulatory environment, including the PSD2 directive, which encourages competition and innovation in payment services. Increasing consumer preference for digital transactions and the rise of fintech companies are key drivers of this growth, as businesses adapt to changing consumer behaviors and regulatory requirements.

Leading countries in Europe include the UK, Germany, and France, where established players like Capgemini and KPMG are making significant strides. The competitive landscape is characterized by a mix of traditional financial institutions and agile fintech startups, creating a vibrant ecosystem. As digital payment adoption accelerates, companies are focusing on enhancing security and user experience to capture market share and meet regulatory standards.

Asia-Pacific : Rapid Growth and Adoption

The Asia-Pacific region is witnessing rapid growth in the Digital Payment Solutions Consulting Services Market, with a market size of 6.75 in 2024. Factors such as increasing smartphone penetration, a young population, and a shift towards cashless transactions are driving this trend. Governments are also promoting digital payment initiatives to enhance financial inclusion and stimulate economic growth, creating a favorable environment for market expansion.

Countries like China, India, and Japan are leading the charge, with major players such as Infosys and Tata Consultancy Services actively participating in the market. The competitive landscape is dynamic, with numerous startups and established firms vying for market share. As digital payment solutions become integral to everyday transactions, companies are investing in innovative technologies to improve efficiency and security, positioning themselves for future growth.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa (MEA) region is gradually emerging in the Digital Payment Solutions Consulting Services Market, with a market size of 1.0 in 2024. The growth is driven by increasing smartphone usage, urbanization, and a young demographic eager for digital solutions. However, challenges such as regulatory hurdles and varying levels of infrastructure development can impede progress. Governments are increasingly recognizing the importance of digital payments for economic development and are implementing supportive policies to foster growth.

Leading countries in the MEA region include South Africa, Nigeria, and the UAE, where local and international players are competing to capture market share. The presence of key players is growing, with firms looking to innovate and adapt to local market needs. As the region continues to develop its digital payment infrastructure, opportunities for consulting services are expected to expand significantly, driven by both consumer demand and regulatory support.