Research methodology on Digital Mobile Radio Market

1. Introduction

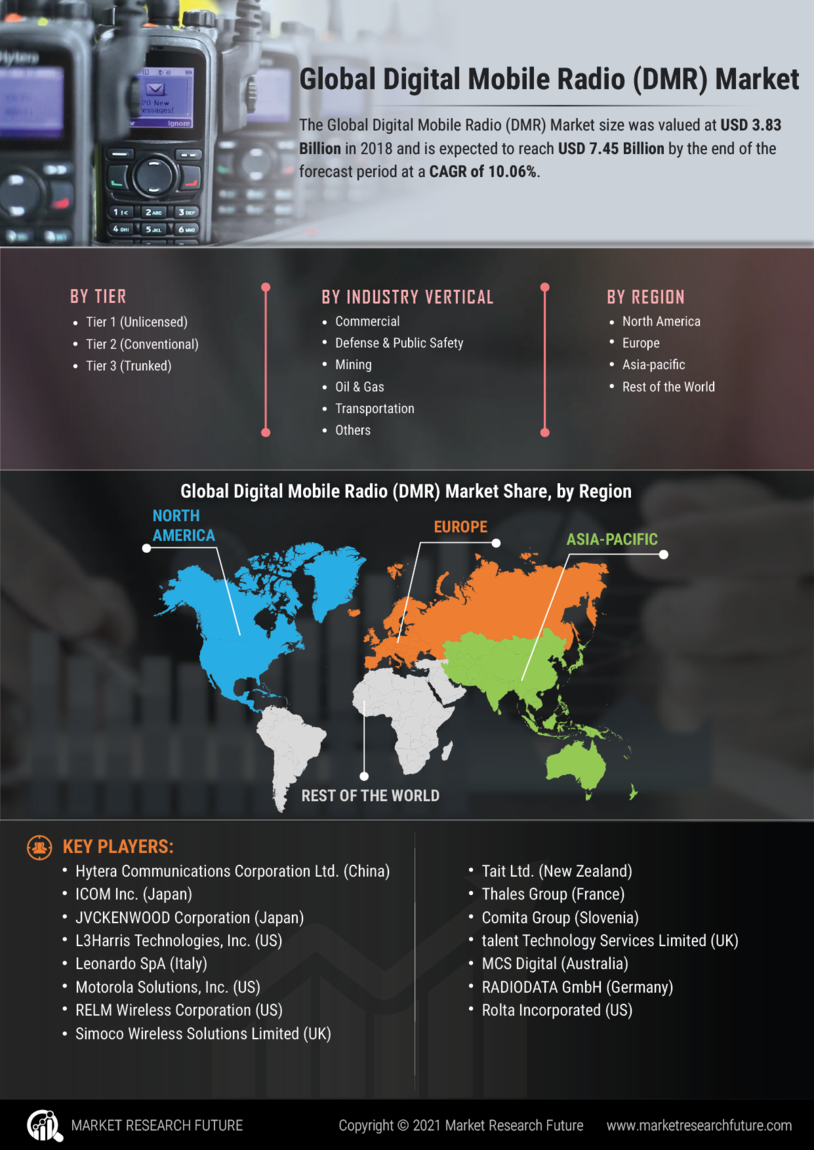

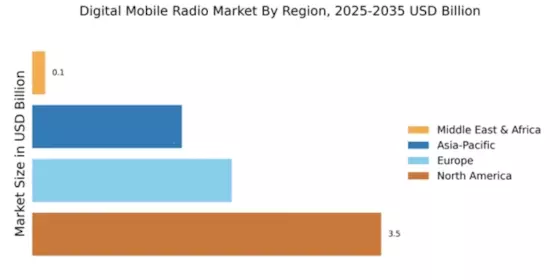

The “Digital Mobile Radio Market” report provides an in-depth analysis of the market for the forecast period 2024-2032. The report covers several aspects such as the market size, segmental analysis, competitive landscape, key drivers and restraints, and regional analysis. It also provides a detailed overview of the market and its development trends over the forecast period.

2. Research Methodology

The research methodology used for this report includes primary and secondary research studies. Primary research includes the investigation of digital mobile radio market trends and drivers. Secondary research includes a review of reports and articles related to the digital mobile radio market.

2.1 Primary research methods

Primary research methods include expert interviews, primary surveys and questionnaire-based studies for understanding the digital mobile radio market.

Industry experts from leading companies in the digital mobile radio market were interviewed to understand their experiences and opinions about the market.

A series of primary surveys and questionnaires were prepared and 200 respondents were recruited to assess their knowledge and attitude towards the digital mobile radio market.

2.2 Secondary research Methods

The secondary research process is conducted to collect data from published sources such as industry magazines, white papers, reports and other reliable sources. The data collected includes facts and figures regarding the market size, growth, trends and participants.

The secondary research also provides in-depth insights into the market segmentations, competitive landscape, and key opportunities.

3. Market Size Estimation and Forecasting

The digital mobile radio market size estimation and forecasting are conducted through various research techniques such as top-down and bottom-up approaches.

The top-down approach is primarily used for dividing the digital mobile radio market into various sub-segments by drawing market insights from secondary research. The bottom-up approach is used for verifying and validating these sub-segments.

The market size and trend data from the secondary research are collected and compared with the current market trends in order to arrive at the forecast figures for the digital mobile radio market.

4. Data Collection and Validation

In order to further validate the market size and trend forecasts, actual data is collected from existing databases and industry participants. This data is then compared to the estimates and forecasts of the market size and trend.

5. Data Analysis and Interpretation

The collected data is then analysed and interpreted using qualitative and quantitative methods. The interpretative analysis is used to understand the underlying factors determining the trends in the digital mobile radio market.

6. Conclusion

The research methodology used for this report provides sufficient insights into the digital mobile radio market. Extensive primary and secondary research is carried out to arrive at the market size and trend forecasts. The data collected is validated through field surveys and interviews with industry experts. The analysis is conducted to understand the underlying factors propelling the digital mobile radio market trends.