Emergence of Industry 4.0

The emergence of Industry 4.0 is reshaping the Digital Manufacturing Software Market. This fourth industrial revolution emphasizes automation, data exchange, and smart manufacturing processes. As manufacturers adopt Industry 4.0 principles, there is a growing need for software solutions that facilitate these transformations. Recent market analysis indicates that the Industry 4.0 market is projected to reach USD 300 billion by 2026, underscoring the potential for software that supports these advanced manufacturing techniques. The integration of technologies such as artificial intelligence, machine learning, and robotics into manufacturing processes necessitates sophisticated software solutions. Consequently, the Digital Manufacturing Software Market is poised for substantial growth as manufacturers seek to leverage Industry 4.0 technologies to enhance productivity and competitiveness.

Sustainability Initiatives

Sustainability is becoming a pivotal focus within the Digital Manufacturing Software Market. Manufacturers are increasingly prioritizing eco-friendly practices and seeking software solutions that support sustainable operations. This shift is driven by regulatory pressures and consumer demand for environmentally responsible products. Recent data suggests that over 70% of manufacturers are investing in sustainability initiatives, which often require advanced software solutions for tracking and reporting. As a result, software providers are developing tools that enable manufacturers to monitor their environmental impact, optimize resource usage, and comply with regulations. This emphasis on sustainability not only enhances brand reputation but also opens new market opportunities, thereby contributing to the growth of the Digital Manufacturing Software Market.

Advancements in IoT Integration

The integration of Internet of Things (IoT) technologies is significantly influencing the Digital Manufacturing Software Market. IoT enables real-time data collection and analysis, which enhances decision-making processes in manufacturing. As manufacturers increasingly adopt IoT solutions, the demand for software that can seamlessly integrate with these technologies is on the rise. Recent statistics indicate that the IoT market in manufacturing is projected to reach USD 400 billion by 2025, highlighting the potential for software solutions that can leverage this data. This integration not only improves operational efficiency but also facilitates predictive maintenance, reducing downtime and costs. Consequently, software providers are focusing on developing solutions that can effectively harness IoT capabilities, thereby driving growth in the Digital Manufacturing Software Market.

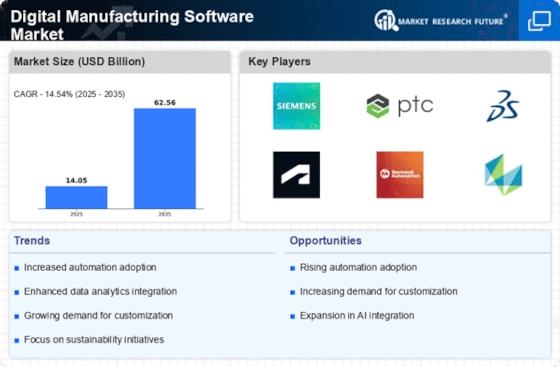

Rising Demand for Customization

The Digital Manufacturing Software Market is experiencing a notable rise in demand for customization solutions. Manufacturers are increasingly seeking software that can be tailored to their specific operational needs. This trend is driven by the necessity for businesses to differentiate themselves in competitive markets. According to recent data, approximately 60% of manufacturers express a preference for customizable software solutions. This inclination towards personalization not only enhances operational efficiency but also fosters innovation within production processes. As a result, software providers are compelled to develop more flexible and adaptable solutions to meet these evolving demands. The ability to customize software is becoming a critical factor in the purchasing decisions of manufacturers, thereby propelling growth within the Digital Manufacturing Software Market.

Increased Focus on Supply Chain Resilience

The Digital Manufacturing Software Market is witnessing an increased focus on supply chain resilience. Manufacturers are recognizing the importance of robust supply chains in mitigating risks associated with disruptions. This awareness has led to a surge in demand for software solutions that enhance supply chain visibility and agility. Recent studies indicate that companies investing in supply chain resilience are likely to see a 20% increase in operational efficiency. As a result, software providers are developing solutions that offer real-time tracking, analytics, and predictive capabilities to help manufacturers navigate uncertainties. This trend is expected to drive significant growth in the Digital Manufacturing Software Market as businesses seek to fortify their supply chains against potential disruptions.