Innovations in Material Science

Advancements in material science are significantly influencing the Poly (Butylene Adipate-Co-Terephthalate) Market. Researchers are continuously exploring new formulations and processing techniques that enhance the properties of Poly (Butylene Adipate-Co-Terephthalate), such as its mechanical strength and thermal stability. These innovations are likely to expand its applicability across various sectors, including automotive, electronics, and consumer goods. For instance, the development of blends that combine Poly (Butylene Adipate-Co-Terephthalate) with other polymers can lead to improved performance characteristics, making it a more viable option for manufacturers. The market for advanced materials is expected to reach USD 1 trillion by 2026, indicating a robust opportunity for Poly (Butylene Adipate-Co-Terephthalate) to play a pivotal role in this evolving landscape.

Consumer Awareness and Education

The increasing awareness and education regarding environmental issues are driving the Poly (Butylene Adipate-Co-Terephthalate) Market. Consumers are becoming more informed about the impact of their choices on the environment, leading to a preference for products made from sustainable materials. This shift in consumer behavior is prompting manufacturers to incorporate Poly (Butylene Adipate-Co-Terephthalate) into their product lines to meet the demand for eco-friendly options. Surveys indicate that a significant percentage of consumers are willing to pay a premium for sustainable products, which could enhance the market position of Poly (Butylene Adipate-Co-Terephthalate). As awareness continues to grow, the market for sustainable materials is expected to expand, providing further opportunities for Poly (Butylene Adipate-Co-Terephthalate) to thrive in the competitive landscape.

Expanding Applications in Packaging

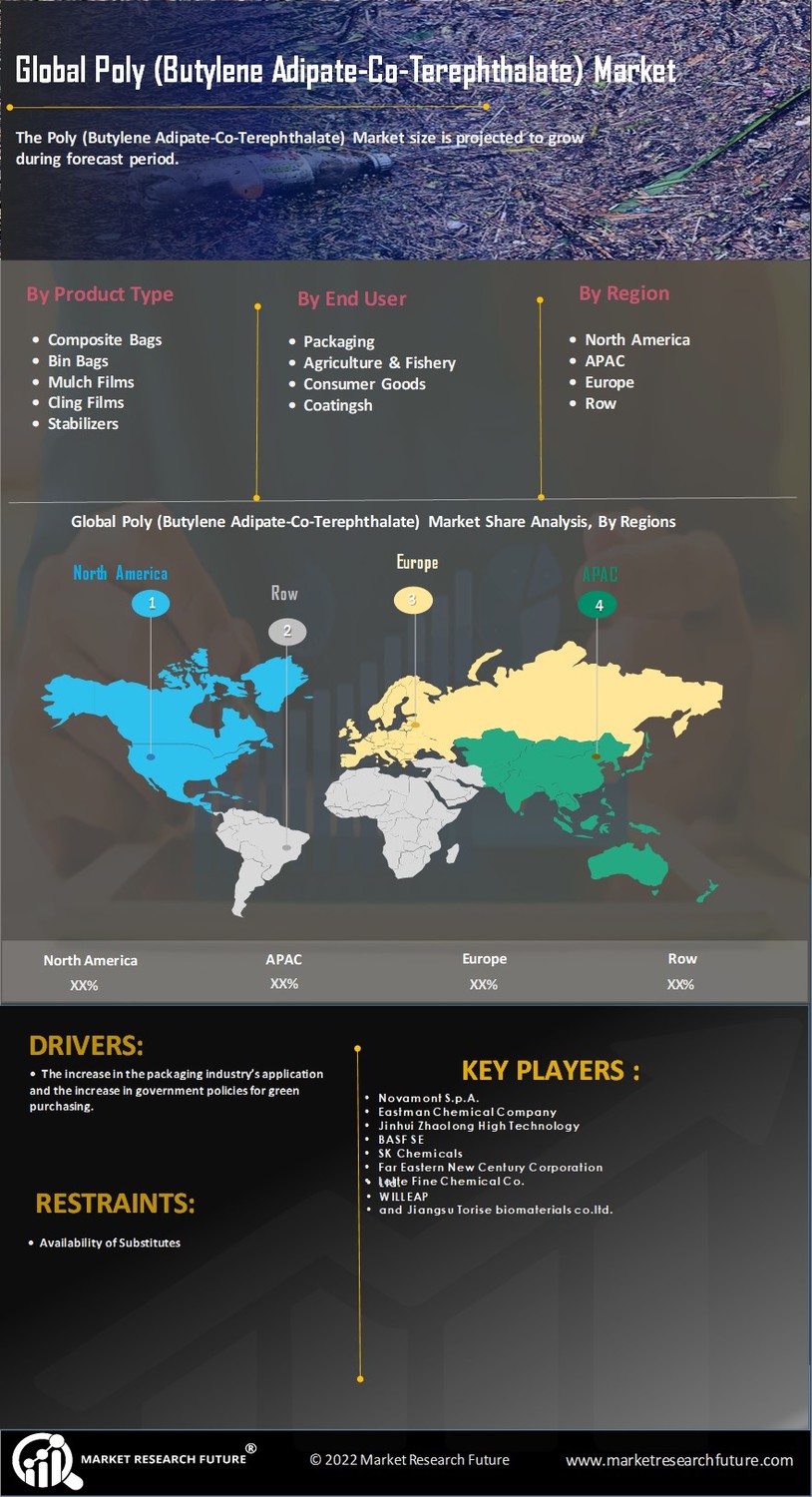

The packaging sector is witnessing a notable shift towards sustainable materials, which is positively impacting the Poly (Butylene Adipate-Co-Terephthalate) Market. With the rise of e-commerce and the demand for eco-friendly packaging solutions, Poly (Butylene Adipate-Co-Terephthalate) is emerging as a preferred choice due to its biodegradability and versatility. Market analysis suggests that the sustainable packaging market is expected to reach USD 500 billion by 2027, with a significant portion attributed to biodegradable materials. This trend indicates a growing acceptance of Poly (Butylene Adipate-Co-Terephthalate) in various packaging applications, including food and beverage, cosmetics, and consumer goods. As companies strive to meet consumer expectations for sustainability, the demand for Poly (Butylene Adipate-Co-Terephthalate) is likely to increase, further propelling the market.

Rising Demand for Biodegradable Plastics

The increasing consumer preference for environmentally friendly products is driving the Poly (Butylene Adipate-Co-Terephthalate) Market. As awareness of plastic pollution grows, manufacturers are seeking alternatives that offer biodegradability without compromising performance. Poly (Butylene Adipate-Co-Terephthalate) is recognized for its biodegradable properties, making it an attractive option for various applications, including packaging and textiles. Market data indicates that the biodegradable plastics segment is projected to grow at a compound annual growth rate of over 20% in the coming years, highlighting the potential for Poly (Butylene Adipate-Co-Terephthalate) to capture a significant share of this expanding market. This trend suggests that companies investing in sustainable materials may gain a competitive edge, further propelling the growth of the Poly (Butylene Adipate-Co-Terephthalate) Market.

Regulatory Support for Sustainable Materials

Government regulations promoting the use of sustainable materials are shaping the Poly (Butylene Adipate-Co-Terephthalate) Market. Many countries are implementing stricter regulations on plastic waste and encouraging the adoption of biodegradable alternatives. This regulatory environment is fostering innovation and investment in the development of sustainable materials, including Poly (Butylene Adipate-Co-Terephthalate). For example, initiatives aimed at reducing single-use plastics are likely to increase demand for biodegradable options, thereby enhancing the market potential for Poly (Butylene Adipate-Co-Terephthalate). As regulations evolve, companies that align their product offerings with these mandates may experience increased market share and consumer loyalty, further driving the growth of the Poly (Butylene Adipate-Co-Terephthalate) Market.