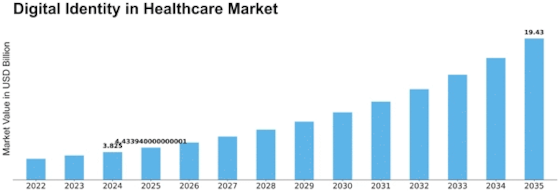

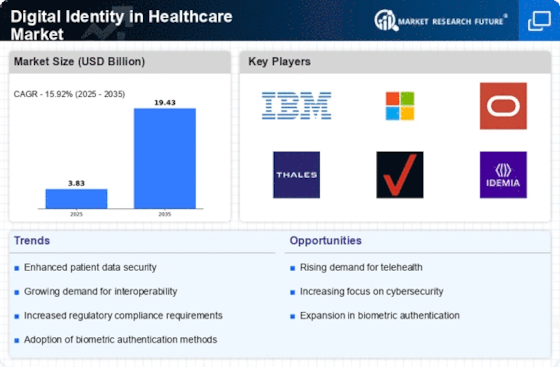

Digital Identity In Healthcare Size

Digital Identity in Healthcare Market Growth Projections and Opportunities

Innovation and the need for safe and efficient patient information management are driving a revolution in healthcare digital identification. Recently, the healthcare business has relied more on digital platforms to speed activities, improve patient care, and secure sensitive health data. Several variables impact the healthcare digital identity industry.

The rise of electronic health records (EHRs) has sparked interest in strong digital identity structures. Secure and standardised identity check methods are needed as healthcare organisations move from paper to electronic records. Digital identification systems ensure that only authorized academics access patient records, protecting sensitive health data and following information security requirements.

In addition, digital threats and information breaches in healthcare have increased the importance of strong digital identification measures. Cybercriminals target patient data, therefore healthcare organizations must constantly improve security. Biometric validation and multidimensional confirmation of digital identities reduce the risk of information breaches and preserve patient protection.

Another major market factor is digital identity interoperability with healthcare systems. Healthcare offices have various programming and equipment, therefore digital identity integration is crucial for functional productivity. Digital identification solutions' ability to interact with healthcare IT systems streamlines work, enhances client experience, and reduces healthcare expert workload.

The global push for telemedicine and remote silent monitoring has also accelerated digital identity in healthcare. With the rise of digital healthcare delivery, safe patient identification is essential. Digital identification agreements allow healthcare providers to authenticate patients remotely, enabling accurate clinical meetings and remote monitoring.

Healthcare digital identity market features reflect administrative changes. States and administrative entities are emphasizing healthcare information security and protection. Compliance with regulations like HIPAA in the US and GDPR in Europe has driven the use of cutting-edge digital identification systems.

Leave a Comment