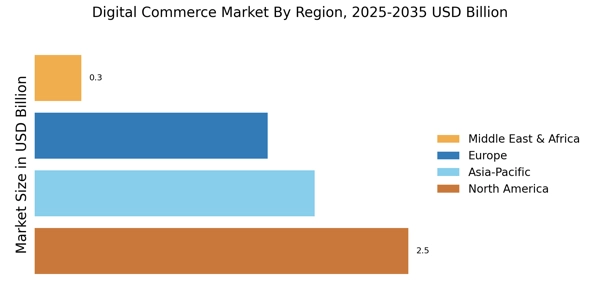

North America : E-commerce Leader

North America is the largest market for digital commerce, holding approximately 40% of the global share. Key growth drivers include high internet penetration, advanced logistics, and a strong consumer base that favors online shopping. Regulatory support for e-commerce, including tax reforms and data protection laws, further fuels this growth. The region's digital commerce landscape is characterized by rapid technological advancements and increasing mobile commerce adoption.

The United States is the leading country in this region, with major players like Amazon, eBay, and Walmart dominating the market. Canada also plays a significant role, with Shopify emerging as a key player. The competitive landscape is marked by innovation and customer-centric strategies, as companies strive to enhance user experience and streamline operations. The presence of established brands and startups alike fosters a dynamic environment for digital commerce.

Europe : Regulatory Frameworks Evolving

Europe is the second-largest market for digital commerce, accounting for around 25% of the global market share. The region's growth is driven by increasing consumer confidence in online shopping, robust payment systems, and a strong emphasis on data protection regulations like GDPR. The European Commission's initiatives to enhance digital single market strategies are also pivotal in shaping the e-commerce landscape, promoting cross-border trade and consumer rights.

Leading countries include Germany, the UK, and France, with significant contributions from platforms like Zalando and local e-commerce players. The competitive landscape is characterized by a mix of established retailers and innovative startups. Companies are increasingly focusing on sustainability and ethical practices to meet consumer expectations, creating a vibrant and competitive digital commerce environment.

Asia-Pacific : Emerging Powerhouse

Asia-Pacific is witnessing explosive growth in the digital commerce market, holding approximately 30% of the global share. The region's rapid urbanization, increasing smartphone penetration, and a young, tech-savvy population are key drivers of this growth. Countries like China and India are leading the charge, supported by favorable government policies that encourage digital transactions and e-commerce development, including initiatives like Digital India and the Belt and Road Initiative.

China is the largest market in this region, with Alibaba and JD.com dominating the landscape. India follows closely, with a burgeoning e-commerce sector led by Flipkart and Amazon. The competitive environment is marked by aggressive pricing strategies and innovative business models, as companies strive to capture the growing online consumer base. The presence of diverse payment options and logistics solutions further enhances the region's digital commerce capabilities.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa represent a rapidly growing segment of the digital commerce market, currently holding about 5% of the global share. Key growth drivers include increasing internet access, mobile penetration, and a young population eager to embrace online shopping. Government initiatives aimed at boosting digital economies, such as the UAE's Vision 2021, are also pivotal in fostering a conducive environment for e-commerce growth.

Leading countries include South Africa, Nigeria, and the UAE, with local players like Jumia and Souq.com making significant strides. The competitive landscape is evolving, with both local and international players vying for market share. The region's unique challenges, such as logistics and payment infrastructure, are being addressed through innovative solutions, paving the way for a more robust digital commerce ecosystem.