Diethylhydroxylamine Size

Diethylhydroxylamine Market Growth Projections and Opportunities

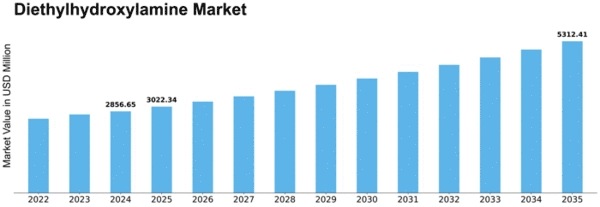

The Diethylhydroxylamine Market Size attained 2.6 B USD in 2022. According to revealed plans, the DEHA market is expected to grow at a rate of 5.8% CAGR, with the industry value increasing 1.6 fold and reaching USD 4.3 billion in 2032 as compared to USD 2.7 billion in 2023.

The DEA market is the subject of diverse factor set that indeed is characterized by several factors that effectively create the market dynamics. Organic substances diethylhydroxylamine (DEHA) is widely used it acts as the key intermediate agent in the manufacture of antioxidants, water treatment chemicals and polymers. It is worth mentioning that one of the biggest growth stimulators in the DEH market is a high use of the substance in a vast scope of industrial applications, with a special attention on constructing chemicals that promote the resilience and quality of many major consumer goods. The utility of DEHA as a good oxygen scavenger and corrosion inhibitor is an additional reason for this material to be popular in water purification contexts.

A technological breakthrough that has revolutionized chemical synthesis and, consequently, the dynamics of the Diethylhydroxylamine market is also among the trends. Continuous research and development are necessary to enhance the effectiveness and sustainability of DEHA production and to explore breakthrough transitions and production methods, as well as to increase the crop's output for different uses. Introduction of new types of production processes and formulation techniques is to be mentioned in order to tackle environmental problems and reduce manufacturing costs and thus a higher level of competitiveness of Diethylhydroxylamine in the market.

The Diethylhydroxylamine based industries, specially in sectors like Polymer, Water treatment and Chemical manufacturing, greatly influence the global market. With the rise in industrial production, there is an accompanying rise in DEM as one of the essential chemical preliminary products. The market dwells on such industrial mixing and blending trends through a universal VOC utilized to stabilize and for the quality of an assortment of industrial processes and products.

The implementation of government regulations and industry standards is the major factors that affect the market of Diethylhydroxylamine. Fulfillment of the regulations such as chemical production, safety, and environmental impact norms is imperative for DEHA companies. The legislations or regulatory changes remain very critical as they determine the use of water treatment chemicals, corrosion inhibitors and other harmful chemicals therefore interfering with the adoption of DEHA as the preferred solution in industrial applications.

In the chemical category, industrial spending as well as factory operations are among the economic factors contributing to the market of Dehydroxylamine. As economic stability emerges and the sector for industrial products becomes invested, DEHA technology gradually enters these sectors to be applied to varied fields. On the contrary, periods of poor economic performance or differences in industrial output levels may determine the market as industries adapt production rates and deal with raw materials of varying quality.

Leave a Comment