Reliability and Performance

Reliability remains a cornerstone of the Diesel-Fired Construction Generator Set Market. Diesel generators are renowned for their robust performance, especially in demanding construction environments where power outages can lead to significant delays and financial losses. The ability of diesel generators to operate continuously under heavy loads makes them a preferred choice among contractors. Recent statistics indicate that diesel generators can run for over 8,000 hours before requiring major maintenance, which is a compelling factor for construction companies. This reliability not only enhances productivity but also ensures that projects adhere to tight schedules, thereby reinforcing the Diesel-Fired Construction Generator Set Market.

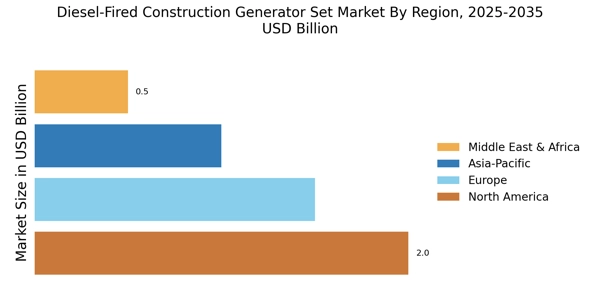

Rising Infrastructure Development

The Diesel-Fired Construction Generator Set Market is experiencing a surge in demand due to the increasing investments in infrastructure development. Governments and private entities are allocating substantial budgets for the construction of roads, bridges, and buildings. This trend is particularly evident in regions where urbanization is accelerating, leading to a heightened need for reliable power sources on construction sites. According to recent data, the construction sector is projected to grow at a compound annual growth rate of approximately 5% over the next few years. Consequently, the demand for diesel-fired generators, known for their durability and efficiency, is likely to rise, further propelling the Diesel-Fired Construction Generator Set Market.

Cost-Effectiveness and Fuel Efficiency

Cost-effectiveness is a pivotal driver in the Diesel-Fired Construction Generator Set Market. Diesel generators are often favored for their fuel efficiency, which translates to lower operational costs over time. The price of diesel fuel, while fluctuating, generally remains more economical compared to alternative energy sources, making diesel generators a financially viable option for construction projects. Recent analyses suggest that diesel generators can provide up to 30% more fuel efficiency than gasoline counterparts, which is a significant consideration for budget-conscious contractors. This economic advantage is likely to sustain the demand for diesel-fired generators in the construction sector, thereby bolstering the Diesel-Fired Construction Generator Set Market.

Technological Innovations and Upgrades

Technological advancements play a crucial role in shaping the Diesel-Fired Construction Generator Set Market. Innovations such as remote monitoring, automated controls, and enhanced fuel management systems are becoming increasingly prevalent. These technologies not only improve the operational efficiency of diesel generators but also provide users with valuable data for better decision-making. The integration of IoT (Internet of Things) capabilities allows for real-time monitoring of generator performance, which can lead to proactive maintenance and reduced downtime. As construction companies seek to optimize their operations, the demand for technologically advanced diesel generators is expected to rise, further driving growth in the Diesel-Fired Construction Generator Set Market.

Environmental Regulations and Compliance

The Diesel-Fired Construction Generator Set Market is also influenced by the evolving landscape of environmental regulations. Stricter emissions standards are being implemented in various regions, compelling manufacturers to innovate and produce cleaner diesel generators. This shift towards compliance with environmental norms is driving the development of advanced technologies that reduce emissions while maintaining performance. For instance, the introduction of Tier 4 compliant engines has become a focal point for manufacturers aiming to meet regulatory requirements. As a result, the Diesel-Fired Construction Generator Set Market is likely to witness a transformation, with an increasing number of eco-friendly options becoming available to consumers.