Diaphragm Pumps Size

Diaphragm Pumps Market Growth Projections and Opportunities

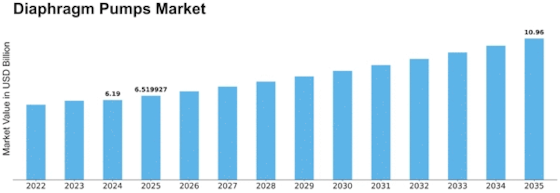

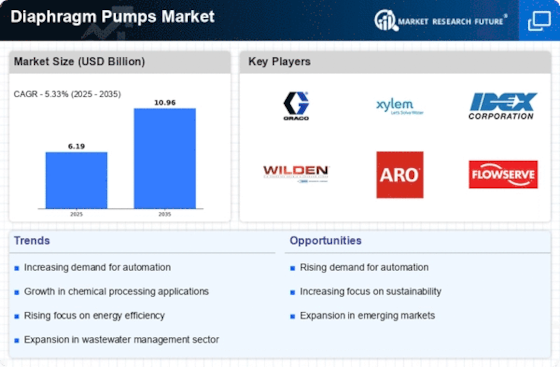

The global market for air-operated double diaphragm pumps is experiencing a substantial surge in demand, primarily propelled by the rapid expansion of industries such as chemicals, oil & gas, water & wastewater, and pharmaceuticals. Projections indicate that the global air-operated double diaphragm pumps market is poised to witness a robust Compound Annual Growth Rate (CAGR) of 5.03% during the forecast period from 2020 to 2026. As of 2019, Asia-Pacific asserted its dominance in the air-operated double diaphragm pumps market, holding a commanding share of 4.034%. Following closely were North America and Europe, capturing shares of 21.84% and 19.78%, respectively.

The segmentation of the global air-operated double diaphragm pumps market takes into account various factors, including valve type, material composition, pressure capabilities, size dimensions, industry applications, and geographic regions. The valve type is subdivided into ball valve and flap valve categories, with the ball valve segment anticipated to exhibit faster growth throughout the forecast period. Notably, in 2019, the ball valve segment already commanded a substantial share, accounting for 57.13% of the overall air-operated double diaphragm pumps market.

As industries across the chemical, oil & gas, water & wastewater, and pharmaceutical sectors continue to expand, the demand for air-operated double diaphragm pumps is expected to witness sustained growth. This trend is underpinned by the versatility and efficiency of these pumps in handling diverse fluids and meeting the intricate requirements of various industrial processes.

The robust growth in the chemical industry, characterized by intricate processes and the need for reliable fluid handling systems, has been a key driver for air-operated double diaphragm pumps. These pumps, equipped with ball valve mechanisms, offer enhanced performance, making them particularly well-suited for the demands of the chemical sector.

Similarly, the oil & gas industry, with its complex fluid transfer and processing needs, has found air-operated double diaphragm pumps to be indispensable. The pumps' ability to handle viscous and abrasive fluids, coupled with their robust construction, positions them as vital components in the oil & gas sector's operations.

In the water & wastewater industry, where efficiency, reliability, and versatility are paramount, air-operated double diaphragm pumps have become integral. The ability of these pumps to handle a wide range of fluids, including those with solid particles, positions them as key players in water treatment and transfer applications.

Moreover, the pharmaceutical industry, with its stringent requirements for hygienic and precise fluid handling, has increasingly adopted air-operated double diaphragm pumps. These pumps, often featuring ball valve configurations, ensure the maintenance of sterile conditions and the precise delivery of pharmaceutical substances.

Looking ahead, the global air-operated double diaphragm pumps market is poised for sustained growth, driven by the ongoing expansion of key industries worldwide. The versatility, efficiency, and reliability of these pumps position them as indispensable components in various industrial processes, ensuring a steady trajectory for the market in the foreseeable future.

Leave a Comment