Emergence of 5G Technology

The advent of 5G technology is significantly influencing the Diameter Interworking Function IWF Market. With the rollout of 5G networks, there is an increasing need for robust interworking functions that can handle the complexities of new service architectures. The transition to 5G is expected to drive demand for Diameter IWF solutions that can facilitate the integration of legacy systems with next-generation networks. Analysts suggest that the market for Diameter IWF is likely to expand as operators seek to leverage 5G capabilities while maintaining compatibility with existing infrastructure. This trend indicates a promising future for Diameter IWF providers who can offer innovative solutions tailored to the demands of 5G.

Increased Focus on Network Security

The Diameter Interworking Function IWF Market is witnessing an increased focus on network security as cyber threats continue to evolve. Telecommunications operators are prioritizing the implementation of robust security measures within their Diameter IWF solutions to protect sensitive data and maintain user trust. This trend is driven by the rising incidence of data breaches and the need for compliance with stringent security regulations. As a result, Diameter IWF providers are innovating to offer solutions that not only facilitate interworking but also incorporate advanced security features. This emphasis on security is likely to shape the competitive landscape of the market, as operators seek reliable partners to safeguard their networks.

Growing Importance of Data Analytics

Data analytics is becoming increasingly vital in the Diameter Interworking Function IWF Market. As operators collect vast amounts of data from various sources, the ability to analyze and utilize this data effectively is essential for optimizing network performance. Diameter IWF solutions that incorporate advanced analytics capabilities enable operators to gain insights into user behavior, network traffic patterns, and service usage. This information can be leveraged to enhance service offerings and improve operational efficiency. The integration of data analytics into Diameter IWF solutions is likely to drive market growth, as operators seek to harness the power of data to make informed decisions and enhance customer experiences.

Rising Demand for Seamless Connectivity

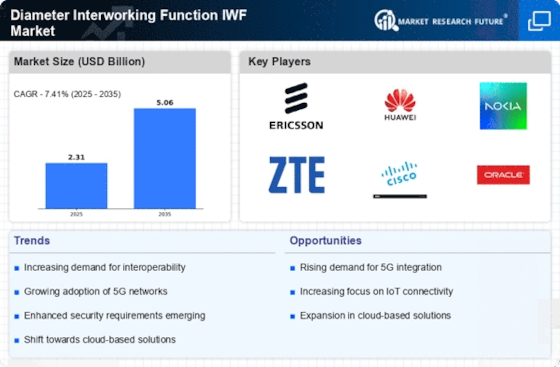

The Diameter Interworking Function IWF Market is experiencing a notable increase in demand for seamless connectivity across various telecommunications networks. As operators strive to enhance user experiences, the need for efficient interworking between different protocols becomes paramount. This demand is driven by the proliferation of mobile devices and the growing reliance on data services. According to recent estimates, the market for Diameter IWF solutions is projected to grow at a compound annual growth rate of approximately 15% over the next five years. This growth reflects the industry's commitment to ensuring that diverse network elements can communicate effectively, thereby facilitating smoother service delivery and improved customer satisfaction.

Regulatory Compliance and Standardization

In the Diameter Interworking Function IWF Market, regulatory compliance and standardization play a crucial role in shaping market dynamics. Telecommunications operators are increasingly required to adhere to stringent regulations regarding data privacy and security. This has led to a heightened focus on implementing Diameter IWF solutions that not only meet these regulatory requirements but also ensure interoperability among various systems. The market is witnessing a shift towards standardized protocols, which simplifies integration and reduces operational complexities. As a result, companies that invest in compliant Diameter IWF solutions are likely to gain a competitive edge, positioning themselves favorably in a rapidly evolving landscape.