Increasing Geopolitical Tensions

The current landscape of international relations appears to be marked by rising geopolitical tensions, which significantly influences the Destroyer Market. Nations are increasingly investing in naval capabilities to assert their presence and protect their interests. For instance, defense budgets in various countries have seen a notable increase, with naval expenditures projected to rise by approximately 5% annually over the next five years. This trend suggests that the demand for advanced destroyers, equipped with cutting-edge technology, is likely to grow as nations seek to enhance their maritime security. The Destroyer Market is thus positioned to benefit from these developments, as governments prioritize the modernization of their fleets to address emerging threats.

Growing Emphasis on Maritime Security

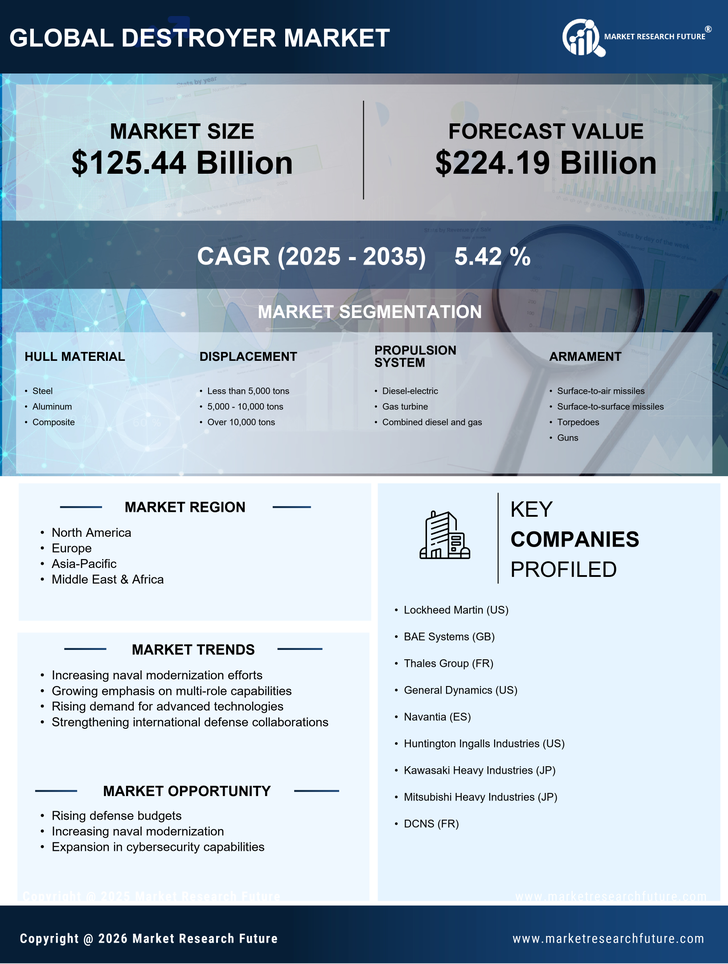

The increasing focus on maritime security is a critical driver for the Destroyer Market. As piracy, smuggling, and territorial disputes become more prevalent, nations are compelled to bolster their naval capabilities. Reports indicate that The Destroyer Market is projected to grow at a compound annual growth rate of 6%, reflecting the urgency for enhanced naval assets. Destroyers, with their multi-role capabilities, are particularly suited for addressing these challenges. Consequently, the demand for advanced destroyers is likely to rise as countries seek to secure their maritime interests and ensure safe navigation in contested waters.

Technological Innovations in Naval Warfare

Technological advancements are reshaping the landscape of naval warfare, which has profound implications for the Destroyer Market. Innovations such as artificial intelligence, advanced radar systems, and unmanned vehicles are becoming integral to modern destroyers. The integration of these technologies is expected to enhance operational efficiency and combat effectiveness. According to recent estimates, the market for naval defense systems, including destroyers, is anticipated to reach USD 30 billion by 2027, driven by the demand for sophisticated naval platforms. This trend indicates that manufacturers in the Destroyer Market must focus on research and development to remain competitive and meet the evolving needs of naval forces.

Strategic Alliances and Defense Collaborations

Strategic alliances and defense collaborations among nations are increasingly shaping the dynamics of the Destroyer Market. Countries are recognizing the benefits of joint development programs and shared resources to enhance their naval capabilities. For example, partnerships between nations for the co-production of destroyers can lead to cost efficiencies and technological sharing. This collaborative approach is expected to drive innovation and reduce time-to-market for new destroyer models. As nations work together to address common security challenges, the Destroyer Market may witness a surge in demand for collaborative defense solutions, fostering a more integrated approach to naval warfare.

Environmental Regulations and Sustainability Goals

The push for sustainability and adherence to environmental regulations is becoming a pivotal factor in the Destroyer Market. As governments commit to reducing their carbon footprints, there is a growing emphasis on developing eco-friendly naval vessels. The integration of green technologies, such as hybrid propulsion systems and energy-efficient designs, is likely to become a standard in new destroyer projects. This shift not only aligns with global sustainability goals but also addresses the increasing scrutiny on military operations' environmental impact. The Destroyer Market must adapt to these changes, as compliance with environmental standards will be essential for future contracts and procurement processes.