Aging Population

The aging population globally contributes to the rising demand for dental services, thereby impacting the Global Dental Needle Market Industry. Older adults often experience various dental issues, necessitating more frequent dental visits and procedures. As the demographic shifts towards an older population, the need for dental interventions increases, leading to a higher consumption of dental needles. This trend is expected to persist, as the proportion of elderly individuals continues to grow. Consequently, the Global Dental Needle Market Industry is likely to expand, catering to the specific needs of this demographic segment.

Regulatory Compliance

Regulatory compliance plays a crucial role in shaping the Global Dental Needle Market Industry. Stringent regulations regarding the safety and efficacy of medical devices, including dental needles, necessitate that manufacturers adhere to high standards. This compliance ensures that products meet safety requirements, which can enhance consumer trust and drive market growth. As regulatory bodies continue to enforce these standards, manufacturers are compelled to innovate and improve their offerings. This dynamic creates a competitive landscape within the Global Dental Needle Market Industry, where compliance becomes a key driver of product development and market expansion.

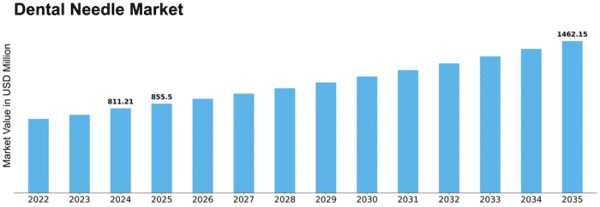

Market Size and Forecast

The Global Dental Needle Market Industry is projected to experience a decline, with an estimated market size of 0.24 USD Billion by 2035. This forecast indicates a compound annual growth rate (CAGR) of -3.52% from 2025 to 2035, suggesting potential challenges ahead. Factors contributing to this decline may include market saturation and the emergence of alternative dental technologies. Stakeholders in the industry must remain vigilant and adapt to these changing dynamics to sustain their market presence. Understanding these trends will be crucial for navigating the future landscape of the Global Dental Needle Market Industry.

Technological Advancements

Technological innovations in dental needle design and manufacturing significantly influence the Global Dental Needle Market Industry. Enhanced safety features, such as retractable needles and improved ergonomics, are becoming standard in modern dental practices. These advancements not only improve patient comfort but also reduce the risk of needlestick injuries for healthcare providers. As a result, dental professionals are more inclined to adopt these innovative products, thereby driving market growth. The Global Dental Needle Market Industry is poised to benefit from these developments, as they align with the increasing emphasis on patient safety and procedural efficiency.

Market Consolidation Trends

The Global Dental Needle Market Industry is witnessing trends of market consolidation, where larger companies acquire smaller firms to enhance their product portfolios and market reach. This consolidation allows for the sharing of resources, technology, and expertise, potentially leading to improved product offerings and competitive pricing. As companies strive to maintain their market positions, this trend may result in a more streamlined industry structure. However, it could also lead to reduced competition, which may impact pricing strategies. The Global Dental Needle Market Industry is likely to evolve as these consolidation trends reshape the competitive landscape.

Increasing Dental Procedures

The Global Dental Needle Market Industry experiences growth due to the rising number of dental procedures performed worldwide. As dental health awareness increases, more individuals seek preventive and corrective treatments, leading to a higher demand for dental needles. In 2024, the market is valued at approximately 0.35 USD Billion, reflecting the industry's response to this growing trend. The expansion of dental clinics and the introduction of advanced technologies in dental practices further contribute to this demand. Consequently, the Global Dental Needle Market Industry is likely to witness sustained growth as dental professionals increasingly rely on these essential tools.

Leave a Comment