North America : Market Leader in Services

North America is poised to maintain its leadership in the Dental Equipment Maintenance & Calibration Services Market, holding a market size of $1.75B in 2025. Key growth drivers include increasing dental procedures, stringent regulatory standards, and technological advancements in dental equipment. The demand for reliable maintenance services is further fueled by the rising awareness of patient safety and equipment reliability.

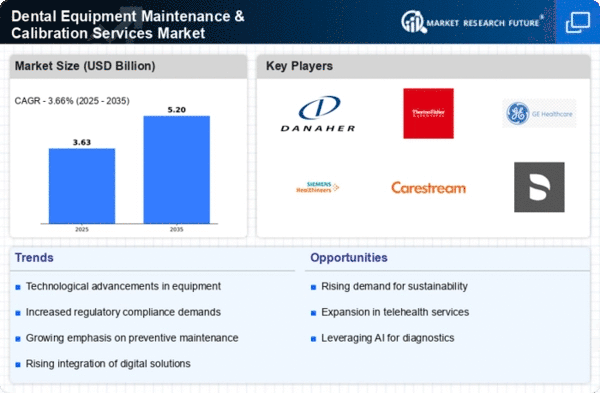

The competitive landscape is characterized by major players such as Danaher Corporation, GE Healthcare, and Dentsply Sirona Inc., which dominate the market. The U.S. is the leading country, contributing significantly to the regional market share. The presence of advanced healthcare infrastructure and a high number of dental practices further enhance the demand for maintenance and calibration services.

Europe : Emerging Market Dynamics

Europe's Dental Equipment Maintenance & Calibration Services Market is projected to reach $1.1B by 2025, driven by an increasing number of dental clinics and a growing emphasis on preventive maintenance. Regulatory frameworks across countries are becoming more stringent, promoting higher standards for dental equipment safety and performance. This regulatory push is a key catalyst for market growth, as dental practices seek compliance with health regulations.

Leading countries in this region include Germany, France, and the UK, where the presence of established players like Siemens Healthineers and Carestream Health is notable. The competitive landscape is evolving, with a mix of local and international companies vying for market share. The focus on innovative solutions and customer service excellence is shaping the competitive dynamics in Europe.

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific region is witnessing rapid growth in the Dental Equipment Maintenance & Calibration Services Market, projected to reach $0.9B by 2025. Key drivers include rising disposable incomes, increasing dental awareness, and a growing number of dental clinics. The region's regulatory environment is also evolving, with governments emphasizing the importance of equipment maintenance to ensure patient safety and service quality.

Countries like China and India are leading the charge, with a significant increase in dental service demand. The competitive landscape features both local and international players, including Thermo Fisher Scientific and Henry Schein Inc. The market is characterized by a focus on affordability and accessibility, catering to a diverse population with varying dental care needs.

Middle East and Africa : Untapped Market Potential

The Middle East & Africa region is emerging as a significant player in the Dental Equipment Maintenance & Calibration Services Market, with a projected size of $0.75B by 2025. Factors driving growth include increasing healthcare investments, a rising number of dental professionals, and a growing awareness of dental health. Regulatory bodies are beginning to implement standards that promote the maintenance of dental equipment, which is crucial for ensuring patient safety.

Countries like South Africa and the UAE are at the forefront of this growth, with a burgeoning dental services sector. The competitive landscape is still developing, with opportunities for both established and new players to enter the market. The presence of key players like 3M Company is expected to enhance service offerings and drive market expansion.