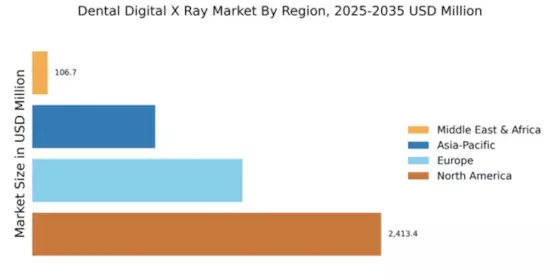

North America : Market Leader in Innovation

North America continues to lead the Dental Digital X-Ray market, holding a significant share of approximately 2413.36 million. The growth is driven by increasing demand for advanced imaging technologies, rising dental care awareness, and supportive regulatory frameworks. The region's focus on innovation and technological advancements in dental imaging is further propelling market expansion, with a notable shift towards digital solutions that enhance diagnostic accuracy and patient outcomes.

The competitive landscape in North America is robust, featuring key players such as Carestream Health, Dentsply Sirona, and Sirona Dental Systems. These companies are at the forefront of technological advancements, offering a range of products that cater to diverse dental practices. The presence of established firms and continuous investment in R&D are crucial for maintaining market leadership, ensuring that North America remains a pivotal region in the global Dental Digital X-Ray market.

Europe : Emerging Market with Growth Potential

Europe's Dental Digital X-Ray market is valued at approximately 1453.62 million, reflecting a growing demand for innovative dental imaging solutions. Factors such as an aging population, increased dental health awareness, and advancements in technology are driving this growth. Regulatory support for digital health initiatives and investments in healthcare infrastructure further enhance market prospects, making Europe a key player in the global landscape.

Leading countries in this region include Germany, France, and the UK, where the presence of major companies like Planmeca and Fujifilm strengthens the competitive environment. The market is characterized by a mix of established players and emerging startups, fostering innovation and diverse product offerings. As the region embraces digital transformation in healthcare, the Dental Digital X-Ray market is poised for significant growth, supported by favorable regulations and increasing consumer demand.

Asia-Pacific : Rapid Growth in Emerging Markets

The Asia-Pacific Dental Digital X-Ray market, valued at around 850.0 million, is experiencing rapid growth driven by increasing dental care accessibility and rising disposable incomes. The region's expanding population and urbanization are contributing to a higher demand for dental services, while government initiatives to improve healthcare infrastructure are further catalyzing market expansion. The shift towards digital solutions is also being supported by advancements in technology and increasing awareness of oral health.

Countries like China, India, and Japan are leading the charge in this market, with significant investments from key players such as Vatech and Konica Minolta. The competitive landscape is evolving, with both local and international companies vying for market share. As the region continues to embrace digital transformation in healthcare, the Dental Digital X-Ray market is set to flourish, driven by innovation and a growing focus on preventive care.

Middle East and Africa : Emerging Market with Untapped Potential

The Middle East and Africa Dental Digital X-Ray market, valued at approximately 106.73 million, presents significant growth opportunities driven by increasing healthcare investments and rising awareness of dental health. The region is witnessing a gradual shift towards digital imaging technologies, supported by government initiatives aimed at enhancing healthcare services. As dental practices modernize, the demand for advanced imaging solutions is expected to rise, contributing to market growth.

Leading countries in this region include South Africa and the UAE, where investments in healthcare infrastructure are on the rise. The competitive landscape is characterized by a mix of local and international players, with companies like Gendex and XDR Radiology making strides in the market. As the region continues to develop its healthcare capabilities, the Dental Digital X-Ray market is poised for expansion, driven by technological advancements and increasing consumer demand for quality dental care.