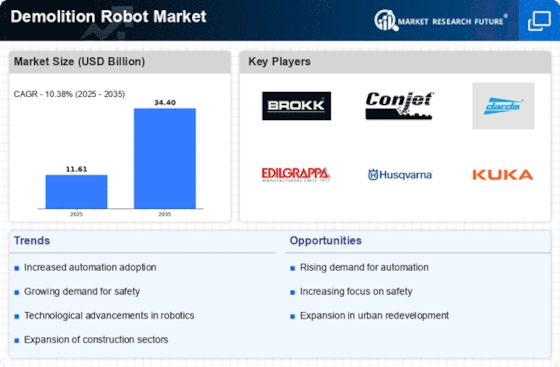

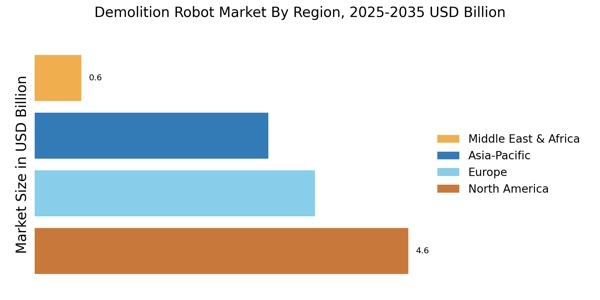

North America : Leading Market for Innovation

North America is the largest market for demolition robots, holding approximately 40% of the global share. The growth is driven by increasing urbanization, infrastructure development, and stringent safety regulations. The demand for efficient and safe demolition methods is rising, supported by government initiatives promoting advanced construction technologies. The U.S. and Canada are the primary contributors to this growth, with significant investments in construction and renovation projects. The competitive landscape in North America features key players like Brokk AB, Husqvarna AB, and KUKA AG, which are leading the market with innovative solutions. The presence of advanced technology and a focus on automation further enhance the region's market position. Additionally, the growing trend of sustainable construction practices is pushing companies to adopt demolition robots, ensuring minimal environmental impact during demolition processes.

Europe : Emerging Market with Regulations

Europe is witnessing significant growth in the demolition robot market, accounting for approximately 30% of the global share. The region's growth is fueled by increasing construction activities, urban redevelopment projects, and stringent environmental regulations. Countries like Germany and Sweden are at the forefront, with government policies encouraging the adoption of advanced demolition technologies to enhance safety and efficiency in construction sites. Leading countries in Europe include Germany, Sweden, and Italy, where companies like Conjet AB and Darda GmbH are making substantial contributions. The competitive landscape is characterized by a mix of established players and innovative startups, focusing on developing eco-friendly demolition solutions. The European market is also influenced by regulations aimed at reducing carbon footprints, pushing for the integration of robotic technologies in construction and demolition processes.

Asia-Pacific : Rapidly Expanding Market Potential

Asia-Pacific is rapidly emerging as a significant player in the demolition robot market, holding around 25% of the global share. The region's growth is driven by rapid urbanization, increasing infrastructure projects, and a growing focus on safety in construction. Countries like China and Japan are leading the charge, with substantial investments in smart construction technologies and automation, which are expected to boost demand for demolition robots in the coming years. China is the largest market in the region, followed by Japan and Australia, where companies like Mecalac and SENNEBOGEN are expanding their presence. The competitive landscape is evolving, with both local and international players vying for market share. The increasing adoption of robotics in construction is supported by government initiatives aimed at enhancing productivity and safety standards, making the Asia-Pacific region a key area for future growth in the demolition robot market.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region is gradually developing in the demolition robot market, holding approximately 5% of the global share. The growth is primarily driven by increasing urbanization, infrastructure development, and a rising demand for efficient demolition methods. Countries like the UAE and South Africa are leading the market, with government initiatives aimed at modernizing construction practices and enhancing safety standards in demolition activities. The competitive landscape in this region is still in its infancy, with a few key players like Edilgrappa Srl and Robot System Products AB making their mark. However, challenges such as economic fluctuations and regulatory hurdles may hinder growth. Despite these challenges, the potential for growth remains significant, driven by ongoing infrastructure projects and a shift towards adopting advanced technologies in construction and demolition.