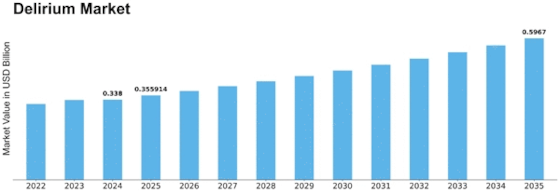

Delirium Size

Delirium Market Growth Projections and Opportunities

The pervasiveness and incidence of delirium shift internationally, impacted by elements like age, fundamental ailments, utilization of medications, and hospitalization, driving business sector interest for symptomatic devices and treatment choices taking special care of impacted people. The maturing population, especially in established nations, adds to the rising predominance of delirium, as more established people are more defenseless to delirium because age related mental degradation and higher pervasiveness of comorbidities, driving business sector growth through more appeal for geriatric care administrations. Fundamental ailments like dementia, contamination, electrolyte imbalance nature, and neurological problems increment the gamble of delirium, impacting market interest for interventions focusing on the hidden causes and comorbidities related with delirium. The utilization of specific medications, like tranquilizers, anticholinergics, and narcotics, builds the risk of delirium, driving business sector interest for elective medications with a lower chance of delirium enlistment and pharmacological interventions focusing on delirium side effects. Hospitalization, especially in intensive care units (ICUs) and postoperative settings, builds the risk of delirium because of variables like lack of sleep, immovable condition, tangible hardship, and prescription organization, driving business sector growth through more appeal for delirium counteraction and the executives procedures in healthcare settings. Varieties in healthcare foundation across districts influence admittance to specific geriatric care administrations, mental offices, and intensive care units fit for overseeing delirium, affecting business sector interest for therapy choices and healthcare administrations. Varieties in health care coverage inclusion for delirium treatment influence market openness and reasonableness for patients, impacting treatment choices and healthcare supplier proposals in regards to delirium the board. Advancing administrative systems for drugs, clinical gadgets, and mental care influence market passage methodologies for organizations creating items and administrations connected with delirium treatment, affecting item accessibility, estimating, and contest elements. Financial factors, for example, healthcare use, Gross domestic product per capita, and healthcare foundation improvement impact market elements by deciding the moderateness and directness of treatment choices for patients with delirium in various areas.

Leave a Comment