Top Industry Leaders in the Defense Light Tactical Vehicle Market

Strategies Adopted By Key Players Defense Light Tactical Vehicle (DLTV) market

Product Diversification: Key players are expanding their product portfolios to cater to diverse military requirements, including reconnaissance, troop transport, and logistics support.

Technological Innovation: Continuous R&D efforts are focused on enhancing vehicle performance, survivability, and connectivity through advanced technologies like autonomous capabilities, integrated sensors, and communication systems.

Strategic Partnerships: Collaborations with government agencies, defense contractors, and technology firms are pursued to leverage expertise, access new markets, and strengthen supply chains.

Global Market Expansion: DLTV manufacturers are targeting international markets by adapting vehicles to meet specific operational needs and complying with regional regulations.

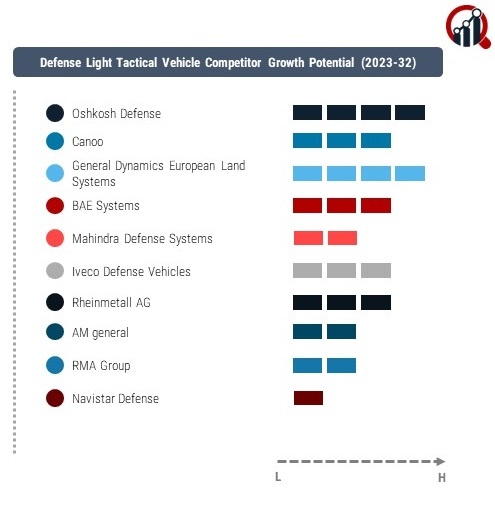

Key Players:

- Oshkosh Defense

- Canoo

- General Dynamics European Land Systems

- BAE Systems

- Mahindra Defense Systems

- Iveco Defense Vehicles

- Rheinmetall AG

- AM general

- RMA Group

- Navistar Defense

- Polaris Government and Defense

- Norinco Group

Factors for Market Share Analysis:

Product Performance and Durability: The reliability, mobility, and durability of DLTVs significantly influence market share, as military customers prioritize vehicles capable of withstanding diverse operational environments.

Cost-Effectiveness: Affordability and lifecycle costs play a crucial role in procurement decisions, prompting manufacturers to offer competitive pricing and efficient support services.

Technological Advancements: Integration of advanced features such as digitalization, electrification, and lightweight materials enhances vehicle capabilities, influencing market preferences.

Regulatory Compliance: Adherence to stringent safety standards, environmental regulations, and interoperability requirements is essential for gaining government contracts and maintaining market share.

New and Emerging Companies:

Supacat: Known for its high-mobility vehicles and off-road capabilities, Supacat is gaining traction in the DLTV market.

Paramount Group: Emerging as a global player in defense solutions, Paramount Group offers innovative tactical vehicle solutions tailored to various operational needs.

Rheinmetall MAN Military Vehicles: Leveraging expertise in automotive engineering, Rheinmetall MAN Military Vehicles specializes in robust, adaptable DLTVs for military applications.

Textron Systems: With a focus on unmanned systems and vehicle autonomy, Textron Systems is entering the DLTV market with innovative solutions.

Industry News and Current Company Investment Trends:

Increased Focus on Electric and Hybrid Vehicles: Many manufacturers are investing in electric and hybrid propulsion systems to enhance fuel efficiency, reduce emissions, and meet sustainability goals.

Strategic Acquisitions and Partnerships: Companies are actively acquiring or partnering with technology startups to integrate novel solutions such as AI, cybersecurity, and augmented reality into DLTV platforms.

Emphasis on Modular Design: Modular architectures enable rapid customization and upgrades, aligning with evolving mission requirements and facilitating cost-effective lifecycle management.

Adoption of Predictive Maintenance: Predictive analytics and condition-based maintenance solutions are gaining prominence, allowing proactive maintenance to minimize downtime and enhance vehicle readiness.

Overall Competitive Scenario:

The DLTV market is characterized by intense competition driven by technological innovation, strategic partnerships, and a focus on meeting evolving defense needs. Established players continue to dominate with their experience, global presence, and diverse product offerings, while new entrants strive to carve out niches through innovation and agility. As governments prioritize modernization and force mobility, the DLTV market is poised for sustained growth, presenting opportunities for both established companies and emerging players to thrive in a dynamic and competitive landscape.

Recent Development:

September 2023, BAE Systems and Larsen & Toubro reached an agreement to provide the Indian army with the BvS10, an articulated all-terrain vehicle (AATV). Articulated vehicles, characterized by multiple separate frames connected by pivot joints, enable sharper turns and are utilized in various sectors such as transportation, including buses, trams, and trains.

August 2023, AM General secured a contract with Navistar Defense for the production of approximately 10,000 JLTV trailers. This subcontract not only enhances AM General's business portfolio but also supports growth initiatives in Mississippi, contributing to its expansion efforts, as mentioned by Wright, a representative of the company.

February 2023, Oshkosh Defense unveiled a 4-door Oshkosh Joint Light Tactical Vehicle (JLTV), featuring an Objective Gunner Protection Kit (OGPK), at the International Defense Exhibition and Conference 2023 held in Abu Dhabi, United Arab Emirates.