Market Analysis

In-depth Analysis of Data Science Platform Market Industry Landscape

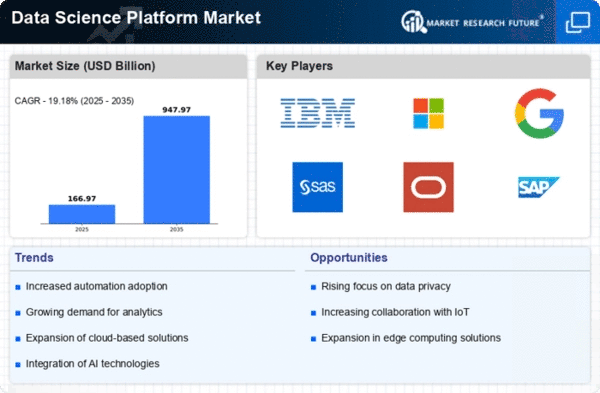

The growing volume and complexity of organizational data is crucial. As organizations try to extract meaningful data from large databases, interest in Data Science Platforms grows. These systems integrate gadgets and technologies for data analysis, AI, and model transmission, streamlining the data science job process. Mechanical improvements shape the Data Science Platform industry. As AI computations, artificial thinking, and big data breakthroughs evolve, Data Science Platforms should lead the way. Driving platforms employ cutting-edge methodologies and algorithms for predictive analysis, design recognition, and data perception.

Market demand for Data Science Platforms is driven by data science democratization. As organizations realize the value of data-driven knowledge, they must involve more clients, including business examiners and space experts, in data science projects. Data Science Platforms' easy interfaces, pre-built models, and openness enable more people to analyze data.

Organizations using Data Science Platforms must consider cost. Traditional data science methods demand significant foundation, skill, and programming technology. Data Science Platforms provide a focused, flexible, and cloud-based environment that lowers ownership costs and makes advanced research more accessible to organizations of all sizes.

Data Science Platform market characteristics include security and consistency. With the growing emphasis on data security and administrative consistency, associations need solutions that focus on security across the data science lifecycle. Driving Data Science Platforms comply with administrative requirements and develop client confidence by integrating robust security features, access restrictions, and inspection capabilities to protect sensitive data.

Interoperability and coordinated effort highlights make Data Science Platforms appealing. In modern organizations, data science involves cross-utilitarian collaboration. Integrated work methods, adaption control, and coordination with diverse data instruments improve efficiency and smooth out the cooperative data science process, making it easier for groups to operate consistently across assignments.

Market competition and seller activity drive Data Science Platform market growth. Competition improves platform features, pricing methods, and customer experiences when more vendors enter the market. Data Science Platform providers differentiate themselves by delivering automated AI, model rationality, and reconciliation with specified data sources to meet customer needs.

Administrative consistency is crucial in markets with strict data management and security regulations. Data science platforms should follow these standards to ensure associations can consistently lead data science efforts. Data Science Platforms are more accepted in directed ventures if they can adapt to varied administrative systems internationally.

Leave a Comment