Focus on Energy Efficiency

Energy efficiency is becoming a critical focus within the Data Center Wire and Cable Market. As data centers consume substantial amounts of energy, there is a growing emphasis on reducing energy costs and minimizing environmental impact. This trend is prompting data center operators to seek out cabling solutions that not only support high performance but also contribute to energy savings. Manufacturers are responding by developing cables that are designed to reduce power consumption while maintaining optimal data transmission speeds. The shift towards energy-efficient solutions is expected to drive innovation and growth within the market, as operators strive to create more sustainable data center environments.

Growth of Internet of Things (IoT)

The rapid expansion of the Internet of Things (IoT) is significantly influencing the Data Center Wire and Cable Market. As more devices become interconnected, the volume of data generated is increasing exponentially, necessitating robust data center infrastructure. This growth requires advanced cabling solutions that can handle the increased data flow and provide reliable connectivity. The integration of IoT devices into various sectors, including healthcare, manufacturing, and smart cities, is expected to drive further investments in data center capabilities. Consequently, the demand for high-performance wire and cable solutions is likely to rise, presenting opportunities for manufacturers in the market.

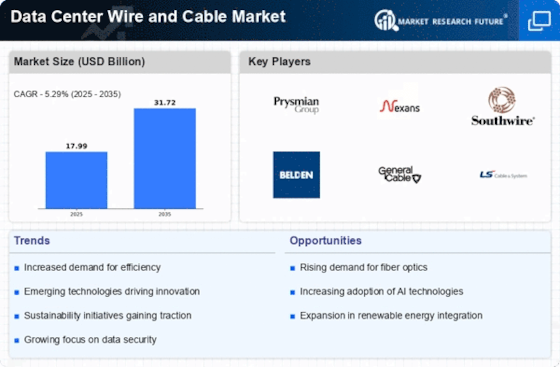

Increasing Demand for Data Centers

The Data Center Wire and Cable Market is experiencing a surge in demand due to the proliferation of data centers. As businesses increasingly rely on digital infrastructure, the need for efficient and reliable wire and cable solutions becomes paramount. According to recent estimates, the number of data centers is projected to grow significantly, driven by the rise of cloud computing and big data analytics. This growth necessitates advanced cabling systems that can support high-speed data transmission and ensure minimal latency. Consequently, manufacturers are focusing on developing innovative wire and cable products tailored to meet the specific requirements of modern data centers, thereby enhancing overall operational efficiency.

Regulatory Compliance and Standards

Regulatory compliance is a significant driver in the Data Center Wire and Cable Market. As data protection and cybersecurity regulations become more stringent, data centers must adhere to specific standards regarding cabling infrastructure. Compliance with these regulations often necessitates the use of high-quality, certified wire and cable products that meet industry benchmarks. This requirement not only ensures the safety and reliability of data transmission but also protects sensitive information from potential breaches. As a result, manufacturers are increasingly focusing on producing compliant products, which in turn drives demand within the market.

Technological Advancements in Cabling Solutions

Technological advancements play a crucial role in shaping the Data Center Wire and Cable Market. Innovations such as high-speed fiber optic cables and advanced copper solutions are transforming the landscape of data transmission. These developments not only improve bandwidth capacity but also enhance energy efficiency, which is increasingly important in data center operations. The introduction of new materials and manufacturing techniques is enabling the production of cables that are lighter, more durable, and capable of supporting higher data rates. As data centers evolve to accommodate growing data traffic, the demand for these advanced cabling solutions is expected to rise, further propelling market growth.