Market Analysis

Data Center Structured Cabling Market (Global, 2023)

Introduction

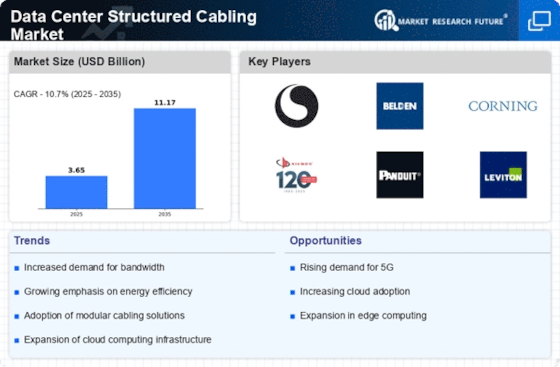

Data Center Structured Cabling Market is a critical part of the telecommunications and IT network, and it serves as the backbone for the transmission of data within the data centers. Consequently, with the increasing digitalization and cloud computing, the demand for robust and scalable data center structured cabling solutions has increased, which has driven the growth of the market. High-speed data transmission, high-performance networks, and high availability are the key drivers for the structured cabling systems. The data center structured cabling market is characterized by a large number of manufacturers, service providers, and system integrators. Moreover, the growing importance of energy efficiency and the need for a sustainable data center has influenced the design and implementation of cabling solutions. This has prompted the industry players to adopt advanced solutions that not only improve the performance but also reduce the energy consumption. The data center structured cabling market is highly dynamic, and therefore, it is essential for businesses to understand the market dynamics to maintain a competitive edge in an interconnected world.

PESTLE Analysis

- Political

- In 2023 the political situation in the data center structured cabling market will be strongly influenced by government regulations aimed at increasing security and data protection. For example, the European Union’s General Data Protection Regulation (GDPR) imposes strict requirements on the way data is handled, which will affect the way data centers manage their cabling systems. This will require a substantial investment from companies, which could need to allocate up to €1 million per year to ensure compliance with the new regulations.

- Economic

- The market for structured cabling in data centers is characterized by fluctuating prices for raw materials and labor. The average cost of copper, the primary material used in structured cabling, is projected to be about CAD 4.50 per kilogram in 2023, an increase of about 10% over the previous year as a result of supply disruptions. In addition, the labor market for skilled technicians in the cabling sector is tightening, with a reported shortage of 50,000 qualified workers in the United States, pushing up labor costs by an estimated 15%.

- Social

- Social trends are increasingly in favor of sustainable and energy-saving solutions in data centers. In 2023, a survey shows that 72% of consumers prefer companies that show commitment to the environment. This is why operators of data centers are investing in sustainable cabling solutions. In addition, the rise of remote working has led to a 30% increase in data traffic. The cabling is being expanded to meet the higher data rates and to optimize the overall experience.

- Technological

- The development of technology has a strong influence on the market for structured cabling. In 2023, the share of fiber-optic cabling is expected to increase, with the installation of fiber-optic cables expected to represent 60 % of new cabling projects, driven by the need for higher data transfer rates. Also, the integration of smart technology such as automatic monitoring systems is increasing, and an estimated 40 % of data centers will use such systems to improve efficiency and minimize downtime.

- Legal

- Legal factors affecting the data center structured cabling market are the compliance with the telecommunications regulations. In 2023, the Federal Communications Commission (FCC) in the United States has set a new standard for data centers, which is expected to cost about $ 200,000 per data center to comply with. Failure to meet these legal requirements can result in penalties and greater scrutiny by regulatory authorities.

- Environmental

- The market for structured cabling in data centers is becoming more and more concerned with the environment. In 2023, it is estimated that data centers will account for 2% of the world's CO2 emissions. This is why many operators are looking for greener solutions. Energy-saving cabling can reduce energy consumption by up to 30%. Many companies have also set themselves the goal of reducing their carbon footprint by 50% by 2030.

Porter's Five Forces

- Threat of New Entrants

- The Data Centers Structured Cabling Market has a medium barrier to entry because of the need for special knowledge and technology. However, the increasing demand for data centers is likely to attract new entrants. Brand loyalty and customer recognition of the established companies may hinder new entrants.

- Bargaining Power of Suppliers

- Suppliers in the market for structured cabling have little power to influence prices, as there are many suppliers of cabling components and materials. The standardized nature of the products further reduces the influence of any one supplier.

- Bargaining Power of Buyers

- High - The buyers in the Data Center Structured Cabling market have significant bargaining power as they can choose from a large number of suppliers and products. The increasing competition among the suppliers has led to a higher sensitivity to price. Moreover, buyers often seek to optimize their investment, which further increases their bargaining power.

- Threat of Substitutes

- There are, of course, other systems which can perform the same functions as the structured cabling system, such as wireless communications, but the reliability and performance of structured cabling systems make them the preferred choice for many data centers. The only threat to structured cabling systems may come from advances in substitute technology.

- Competitive Rivalry

- The competition in the data center structured cabling market is high. There are many competitors vying for market share. Price, quality, and technological innovation are the main factors driving competition. The rapid growth of the data center industry has also intensified competition, as competitors strive to differentiate themselves and capture new business opportunities.

SWOT Analysis

Strengths

- High demand for data centers due to increasing data consumption and cloud services.

- Technological advancements leading to more efficient and reliable cabling solutions.

- Strong growth in the IT and telecommunications sectors driving market expansion.

Weaknesses

- High initial installation costs for structured cabling systems.

- Complexity in installation and maintenance requiring skilled labor.

- Rapid technological changes may lead to obsolescence of existing systems.

Opportunities

- Growing adoption of IoT and smart technologies increasing cabling needs.

- Expansion of 5G networks creating demand for advanced cabling solutions.

- Potential for growth in emerging markets with increasing digital infrastructure investments.

Threats

- Intense competition leading to price wars and reduced profit margins.

- Economic downturns affecting capital expenditure on data center infrastructure.

- Cybersecurity threats that may impact the reliability of cabling systems.

Summary

The Data Center Structured Cabling Market in 2023 is characterized by strong demand, primarily due to technological developments and the growth of cloud services. However, the market is characterized by high installation costs and the need for skilled labor. Opportunities are offered by new technologies such as IoT and 5G, while competition and economic fluctuations can have an impact on the level of profitability. Strategically, innovation and expansion of the market are the main priorities for the market participants.

Leave a Comment