Top Industry Leaders in the Data Center Structured Cabling Market

Competitive Landscape of Data Center Structured Cabling Market:

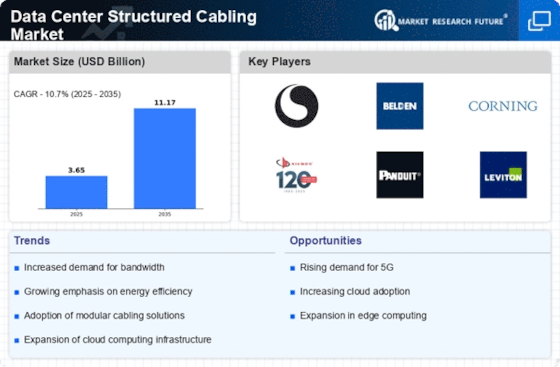

The global data center structured cabling market is experiencing significant growth due to the increasing demand for high-speed data transmission and the proliferation of data centers. The market is highly competitive, with established players like Commscope Holding, Panduit, Corning, Legrand, and Nexans holding a dominant market share. However, new and emerging players are also entering the market, offering innovative solutions and competitive pricing.

Key Players:

- R&M

- Nexans S.A.

- Furukawa Electric Co

- Legrand

- Belden, Inc

- Schneider Electric

- CommScope

- Panduit Corp

- Corning Inc

- Siemon

Strategies Adopted:

The key players in the data center structured cabling market are adopting various strategies to maintain their market position and gain a competitive edge. These strategies include:

- Innovation: Companies are investing in research and development to develop new and innovative products and solutions that meet the evolving needs of data center operators.

- Expansion: Companies are expanding their product portfolios and geographical reach to cater to a wider range of customers.

- Partnerships: Companies are forming partnerships with other technology vendors to offer integrated solutions and services.

- Acquisitions: Companies are acquiring smaller players to expand their market share and gain access to new technologies.

- Focus on Sustainability: Companies are placing increased emphasis on sustainable practices, such as using eco-friendly materials and reducing energy consumption.

Factors for Market Share Analysis:

Several factors influence market share analysis in the data center structured cabling market. These factors include:

- Product Portfolio: Companies with a broader product portfolio catering to various data center needs tend to hold a larger market share.

- Brand Reputation: Companies with a strong brand reputation and a track record of delivering high-quality products enjoy greater customer loyalty and market share.

- Global Reach: Companies with a strong global presence and a well-established distribution network are better positioned to capture market share in different regions.

- Pricing Strategy: Competitive pricing strategies can help companies attract new customers and gain market share.

- Customer Service: Providing excellent customer service can help companies build strong relationships with customers and retain their business.

New and Emerging Companies:

Several new and emerging companies are entering the data center structured cabling market, offering innovative solutions and competitive pricing. These companies are challenging the established players and forcing them to adapt their strategies. Some notable examples of new and emerging companies include:

- FiberLight: FiberLight is a leading provider of fiber optic infrastructure and services for data centers and other high-bandwidth applications.

- AFL Telecommunications: AFL Telecommunications is a provider of fiber optic cables, connectivity products, and installation services.

- Microduct Technologies: Microduct Technologies offers microduct-based solutions for data center cabling, which offer several advantages over traditional cabling methods.

- Data Center Systems: Data Center Systems offers prefabricated data center modules that include pre-installed cabling infrastructure, reducing deployment time and cost.

Current Company Investment Trends:

Companies in the data center structured cabling market are currently investing heavily in the following areas:

- High-Performance Cables: Developing high-performance cables capable of supporting faster data transmission speeds and higher bandwidth requirements.

- Smart Cabling Systems: Developing smart cabling systems that can be monitored and managed remotely, optimizing data center performance.

- Wireless Technologies: Exploring the potential of wireless technologies for data center cabling applications to improve flexibility and scalability.

- Prefabrication: Increasing investments in prefabricated data center modules to reduce installation time and cost.

- Sustainability: Investing in sustainable practices and developing eco-friendly cabling solutions.

Latest Company Updates:

R&M, a Wetzikon, Switzerland-based company that develops and provides cabling systems for premium network infrastructures, is shrunking RJ45 patch cords in 2019. ThinLine cables, which were just introduced, take up 25% less space than standard patch cords. Raised floors, cable guides, and distribution cabinets will all be used more effectively as a result. Installations already in place can be compressed even more.

The fifth data centre will be built by NTT Ltd in 2019 at its Cyberjaya Campus in Malaysia. The international data centre operator will also build an underwater connection to link various South East Asian locales.