Emergence of Edge Computing

The emergence of edge computing is reshaping the landscape of the Data Center Processor Market. As organizations seek to process data closer to the source, the need for specialized processors that can handle edge workloads is becoming increasingly critical. This shift is anticipated to create new opportunities for processor manufacturers, as edge computing is expected to account for a significant portion of data processing activities in the coming years. The Data Center Processor Market must adapt to these changes by developing processors that are optimized for low-latency and high-efficiency operations, thereby meeting the evolving demands of edge computing.

Increased Focus on Data Security

The heightened focus on data security is a crucial driver in the Data Center Processor Market. With the rise in cyber threats and data breaches, organizations are prioritizing the implementation of secure processing solutions. This trend is leading to the development of processors equipped with advanced security features, such as hardware-based encryption and secure boot capabilities. As businesses invest in safeguarding their data, the demand for processors that can provide enhanced security measures is likely to grow. This focus on security not only influences purchasing decisions but also shapes the innovation landscape within the Data Center Processor Market.

Growth of Cloud Computing Services

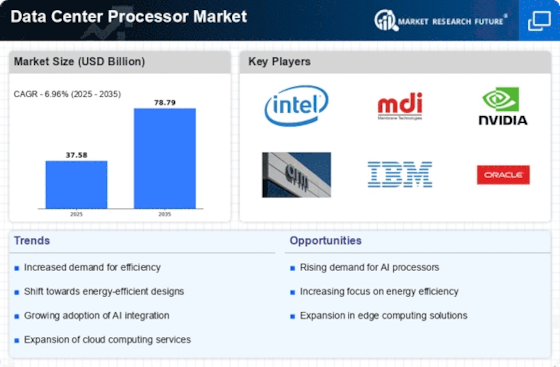

The rapid expansion of cloud computing services significantly influences the Data Center Processor Market. As more businesses migrate to cloud-based solutions, the need for robust data center infrastructure becomes paramount. This shift is evidenced by the increasing investments in data centers, which are projected to grow at a compound annual growth rate of around 15% over the next few years. Consequently, the demand for efficient and powerful processors that can support cloud operations is on the rise. This trend not only enhances the performance of cloud services but also drives innovation within the Data Center Processor Market.

Advancements in Processor Technology

Advancements in processor technology are significantly impacting the Data Center Processor Market. Innovations such as multi-core architectures, improved fabrication processes, and integration of artificial intelligence capabilities are driving the development of more powerful and efficient processors. These technological advancements enable data centers to optimize their operations, reduce energy consumption, and enhance overall performance. As a result, the market for data center processors is expected to witness substantial growth, with new technologies emerging to meet the increasing demands of data processing and storage. This continuous evolution in processor technology is a key factor propelling the Data Center Processor Market.

Demand for High-Performance Computing

The increasing demand for high-performance computing solutions is a primary driver in the Data Center Processor Market. Organizations across various sectors, including finance, healthcare, and scientific research, require advanced processing capabilities to handle large datasets and complex computations. This trend is reflected in the projected growth of the data center processor market, which is expected to reach a valuation of approximately 50 billion dollars by 2026. As businesses seek to enhance their computational power, the demand for processors that can deliver superior performance continues to rise, thereby propelling the Data Center Processor Market forward.