Market Analysis

In-depth Analysis of Data Center Infrastructure Market Industry Landscape

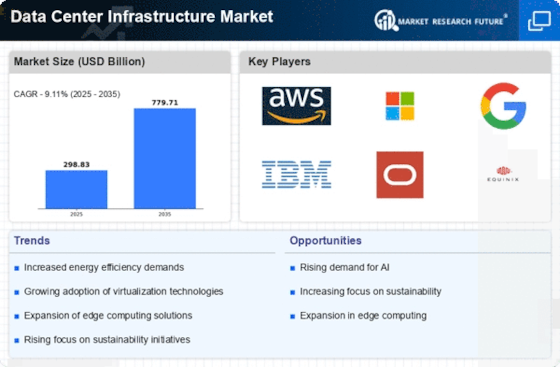

In recent years, the data center infrastructure market has been experiencing significant growth and transformation, driven by the increasing demand for computing power, storage capacity, and network connectivity to support the growing volume of digital data generated by businesses and consumers. Data centers play a critical role in enabling the storage, processing, and transmission of data across various industries, from cloud computing and e-commerce to finance and healthcare. One of the key trends in this market is the shift towards hyper-converged infrastructure (HCI), which integrates compute, storage, networking, and virtualization resources into a single, software-defined platform. HCI solutions offer greater scalability, flexibility, and simplicity compared to traditional hardware-based infrastructure, enabling organizations to streamline deployment, management, and maintenance of their data center environments.

Moreover, there is a growing emphasis on energy efficiency and sustainability within the data center infrastructure market. As data centers continue to consume a significant amount of energy and contribute to carbon emissions, there is a growing focus on reducing the environmental impact of data center operations. Data center operators are adopting energy-efficient technologies such as advanced cooling systems, modular designs, and renewable energy sources to minimize power consumption and carbon footprint. Additionally, innovations in hardware design, such as low-power processors and solid-state drives (SSDs), are helping to improve energy efficiency and reduce operational costs for data center operators.

Another key trend in the data center infrastructure market is the adoption of software-defined networking (SDN) and network function virtualization (NFV) technologies to enhance network agility, scalability, and performance. SDN enables organizations to centrally manage and automate network configurations, policies, and traffic flows using software-based controllers, reducing the complexity and manual intervention required for network management. NFV, on the other hand, virtualizes network functions such as firewalls, load balancers, and routers, allowing organizations to deploy and scale network services more efficiently and cost-effectively. By leveraging SDN and NFV technologies, organizations can improve network flexibility, reduce deployment time, and support emerging applications and services such as cloud computing, edge computing, and 5G networks.

Furthermore, there is a growing trend towards edge computing infrastructure to support the increasing demand for low-latency, high-bandwidth applications and services such as IoT, autonomous vehicles, and real-time analytics. Edge computing involves processing data closer to the source of generation, such as IoT devices, sensors, and mobile devices, rather than in centralized data centers. Edge computing infrastructure includes micro data centers, edge servers, and network edge devices that enable organizations to distribute computing resources and services geographically closer to end-users and devices. By deploying edge computing infrastructure, organizations can reduce latency, improve reliability, and enhance the user experience for latency-sensitive applications and services.

Additionally, the data center infrastructure market is witnessing increased investment in hybrid and multi-cloud environments to support the diverse needs of modern businesses. Hybrid cloud combines public cloud services with private cloud or on-premises infrastructure, allowing organizations to leverage the scalability and flexibility of the public cloud while maintaining control over sensitive data and applications. Multi-cloud, on the other hand, involves using multiple cloud providers to distribute workloads and mitigate vendor lock-in risks. Data center infrastructure providers are offering hybrid and multi-cloud solutions that enable organizations to seamlessly integrate and manage workloads across different cloud environments, providing greater agility, resilience, and cost optimization for their IT operations.

Moreover, there is a growing focus on security and compliance within the data center infrastructure market, driven by the increasing frequency and sophistication of cyber threats and regulatory requirements. Data center operators are implementing advanced security measures such as encryption, multi-factor authentication, and intrusion detection systems to protect sensitive data and infrastructure from unauthorized access and cyber attacks. Additionally, data center infrastructure providers are investing in compliance certifications and audits to ensure that their facilities meet industry standards and regulatory requirements for data privacy, security, and uptime. By prioritizing security and compliance, organizations can mitigate risks, safeguard their data assets, and maintain trust and confidence among customers and stakeholders.

Leave a Comment