Rising Demand for Data Processing

The Data Center Containment Market experiences a notable surge in demand for data processing capabilities. As organizations increasingly rely on data analytics and cloud computing, the need for efficient data centers becomes paramount. This trend is reflected in the projected growth of the data center market, which is expected to reach USD 200 billion by 2026. Enhanced data processing capabilities necessitate advanced containment solutions to optimize cooling and energy efficiency. Consequently, the Data Center Containment Market is likely to benefit from this rising demand, as companies seek to enhance their operational efficiency and reduce costs associated with energy consumption. The integration of containment strategies can lead to improved airflow management, thereby supporting the growing data processing requirements.

Regulatory Compliance and Standards

The Data Center Containment Market is significantly influenced by the increasing emphasis on regulatory compliance and industry standards. Governments and regulatory bodies are implementing stringent guidelines to ensure energy efficiency and environmental sustainability in data centers. For instance, regulations such as the Energy Efficiency Directive and various local mandates compel data center operators to adopt containment solutions that minimize energy waste. This regulatory landscape creates a favorable environment for the Data Center Containment Market, as companies strive to meet compliance requirements while optimizing their operational costs. The potential for penalties and the need for certifications further drive the adoption of effective containment strategies, positioning the industry for sustained growth.

Growing Awareness of Environmental Impact

The Data Center Containment Market is witnessing a shift in focus towards environmental sustainability. As awareness of climate change and environmental degradation increases, organizations are compelled to adopt practices that minimize their carbon footprint. Data centers are significant consumers of energy, and the implementation of containment solutions can lead to substantial reductions in energy consumption and greenhouse gas emissions. The market is projected to grow as companies prioritize sustainability initiatives, with many aiming for carbon neutrality by 2030. This growing awareness not only influences operational strategies but also enhances the appeal of the Data Center Containment Market, as businesses seek to align with environmentally responsible practices.

Technological Advancements in Cooling Solutions

Technological advancements play a crucial role in shaping the Data Center Containment Market. Innovations in cooling solutions, such as liquid cooling and advanced airflow management systems, are becoming increasingly prevalent. These technologies not only enhance cooling efficiency but also contribute to energy savings, which is a critical concern for data center operators. The market for cooling solutions is projected to grow at a CAGR of 10% over the next five years, indicating a robust demand for innovative containment strategies. As data centers evolve to accommodate higher densities of computing power, the Data Center Containment Market is likely to see a corresponding increase in the adoption of these advanced cooling technologies, thereby driving market growth.

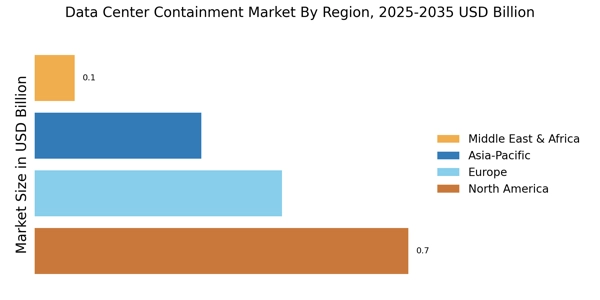

Increased Investment in Data Center Infrastructure

Investment in data center infrastructure is a key driver for the Data Center Containment Market. As businesses expand their digital operations, there is a corresponding need for robust data center facilities. The global data center investment is expected to exceed USD 150 billion by 2025, highlighting the urgency for effective containment solutions. This influx of capital is likely to spur the development of advanced containment technologies that enhance operational efficiency and reduce energy costs. Furthermore, as organizations seek to future-proof their data centers, the Data Center Containment Market stands to gain from increased investments aimed at optimizing space utilization and improving overall performance.