Regulatory Compliance and Standards

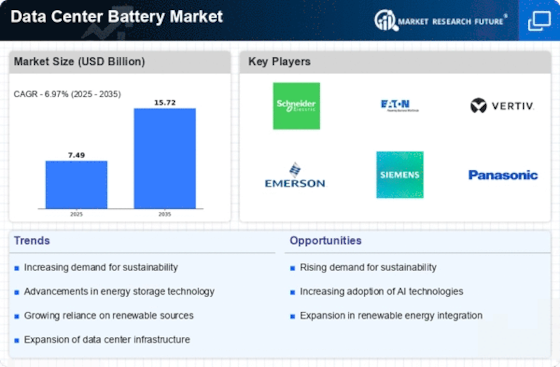

The Data Center Battery Market is significantly influenced by evolving regulatory frameworks and compliance standards. Governments and regulatory bodies are increasingly mandating stringent energy efficiency and sustainability measures for data centers. This has prompted operators to invest in advanced battery technologies that not only meet these regulations but also enhance operational efficiency. For instance, regulations aimed at reducing carbon footprints are pushing data centers to adopt greener battery solutions. As a result, the market is expected to witness a compound annual growth rate of around 8% over the next few years, as companies strive to align with these compliance requirements while optimizing their energy consumption.

Growth of Renewable Energy Integration

The integration of renewable energy sources into data center operations is becoming a pivotal driver for the Data Center Battery Market. As organizations aim to reduce their carbon emissions, the adoption of solar and wind energy is on the rise. Batteries play a crucial role in this transition, providing storage solutions that enable data centers to utilize renewable energy effectively. In 2025, it is anticipated that the market for energy storage systems will expand significantly, with a projected increase of 15% in battery installations. This shift not only supports sustainability goals but also enhances energy independence for data centers, allowing them to operate more efficiently and cost-effectively.

Rising Demand for Uninterrupted Power Supply

The increasing reliance on data centers for critical operations has led to a heightened demand for uninterrupted power supply solutions. As businesses continue to digitize their operations, the need for reliable energy sources becomes paramount. The Data Center Battery Market is experiencing growth as organizations seek to mitigate risks associated with power outages. In 2025, the market is projected to reach a valuation of approximately 10 billion dollars, driven by the necessity for continuous uptime. This trend is particularly evident in sectors such as finance and healthcare, where data integrity and availability are crucial. Consequently, investments in advanced battery systems are likely to surge, as companies prioritize resilience in their infrastructure.

Technological Advancements in Energy Storage

Technological innovations in energy storage systems are reshaping the Data Center Battery Market. The development of high-capacity, fast-charging batteries is enabling data centers to enhance their energy management strategies. These advancements allow for better load balancing and energy efficiency, which are critical in meeting the demands of modern data processing. As of 2025, the market is expected to see a surge in the adoption of lithium-ion and solid-state batteries, which offer improved performance and longevity. This trend is likely to drive competition among manufacturers, leading to further innovations and cost reductions in battery technologies, ultimately benefiting data center operators.

Increased Focus on Disaster Recovery Solutions

The growing emphasis on disaster recovery and business continuity planning is a key driver for the Data Center Battery Market. Organizations are increasingly recognizing the importance of having robust backup power solutions to ensure operational resilience during unforeseen events. This has led to a surge in demand for advanced battery systems that can provide reliable power during emergencies. In 2025, the market is projected to grow by approximately 12%, as companies invest in comprehensive disaster recovery strategies. The integration of battery systems into these plans not only enhances reliability but also supports the overall efficiency of data center operations, making them more resilient to disruptions.