North America : Market Leader in Data Services

North America continues to lead The Data Backup and Recovery Services, holding a significant share of 10.5 in 2024. The region's growth is driven by increasing data generation, stringent regulatory requirements, and a rising focus on data security. Organizations are investing heavily in advanced backup solutions to mitigate risks associated with data loss and cyber threats. The demand for cloud-based services is also on the rise, further propelling market growth.

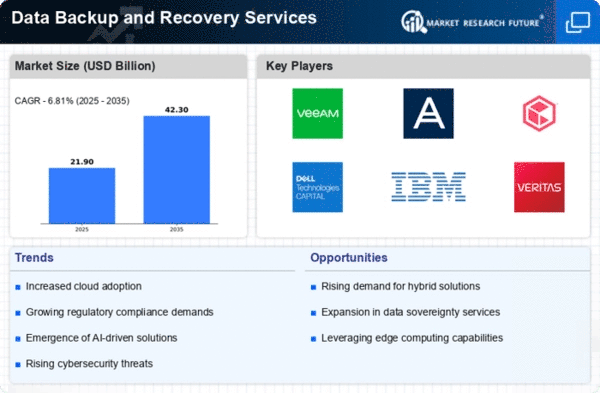

The competitive landscape in North America is robust, featuring key players such as Veeam Software, Commvault, and Dell Technologies. The U.S. stands out as the largest market, driven by technological advancements and a high adoption rate of innovative solutions. Companies are increasingly partnering with service providers to enhance their data management capabilities, ensuring compliance with regulations and improving operational efficiency.

Europe : Emerging Market with Growth Potential

Europe's data backup and recovery services market is poised for growth, with a market size of 5.5 in 2024. The region is witnessing a surge in demand for data protection solutions, driven by increasing regulatory pressures such as GDPR and a growing awareness of data privacy. Organizations are prioritizing investments in backup solutions to ensure compliance and safeguard sensitive information, which is crucial in today's digital landscape.

Leading countries in Europe include Germany, the UK, and France, where major players like Acronis and Veritas Technologies are making significant inroads. The competitive landscape is characterized by a mix of established firms and emerging startups, all vying for market share. The European market is expected to see increased collaboration between technology providers and enterprises to enhance data resilience and recovery capabilities.

Asia-Pacific : Rapidly Growing Data Market

The Asia-Pacific region is rapidly emerging as a key player in the data backup and recovery services market, with a market size of 3.5 in 2024. The growth is fueled by the increasing adoption of cloud technologies, rising data generation, and a growing emphasis on data security. Governments in the region are also implementing regulations to enhance data protection, which is driving demand for reliable backup solutions among businesses of all sizes.

Countries like China, India, and Japan are leading the charge, with significant investments in data infrastructure and technology. The competitive landscape features both global players and local firms, creating a dynamic environment for innovation. Companies are focusing on developing tailored solutions to meet the unique needs of diverse industries, ensuring robust data management and recovery strategies.

Middle East and Africa : Emerging Market with Untapped Potential

The Middle East and Africa region is gradually emerging in the data backup and recovery services market, with a market size of 1.0 in 2024. The growth is driven by increasing digital transformation initiatives and a rising awareness of data security among organizations. Governments are also playing a crucial role by implementing regulations that mandate data protection, which is fostering demand for backup solutions across various sectors.

Leading countries in this region include South Africa and the UAE, where local and international players are establishing a presence. The competitive landscape is evolving, with companies focusing on providing customized solutions to cater to the unique challenges faced by businesses in this region. As the market matures, there is significant potential for growth and innovation in data management services.