Cyclopentane Size

Cyclopentane Market Growth Projections and Opportunities

The Cyclopentane market is determined by different market factors that drive the magnitude and narrative of its performance. One of the most influencing forces behind the growth of this market is the rising demand for ecologically safe substitutes for R-22. Consequently, industries, with a growing emphasis on sustainability and environmental issues, are looking for alternatives with low or non-GWP to replace traditional refrigerants. Cyclopentane being a hydrocarbon with a low GWP is becoming an increasingly acceptable option and many industries, such as the refrigeration and foam-blowing business are incorporating it as an alternative due to the low GWP.

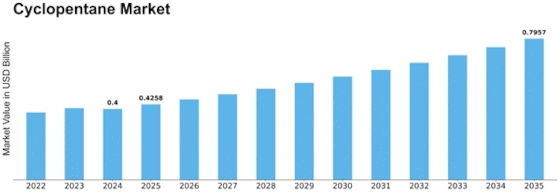

Cyclopentane Market Size reached US$ 0.35 billion in the year 2022. The Industry of Cyclopentane is estimated to build up its market size from USD0.3759 billion in 2023 to the level of USD 0.665436 billion in 2032 with the CAGR of 16.26%. Last but not the least, the blowing-agent sector is another important sector of the market as it grows. Cyclopentane is increasingly employed as a blowing agent to create flexible foams for polyurethane insulations, packaging solutions, and construction forms. Worldwide, construction activities are increasing all the time, where the need for energy efficient insulation is raising also, this is a positive sign for the growth of the cyclopentane market.

Secondly, there is an increasing growing appetite for gadgets such as refrigerators, air conditioners and others, which creates an upsurge in the market size. The cyclopentane is often used as that blowing agent in the insulation foam used in making appliances like air-conditioning. With the continuous development of consumer electronics, especially in emerging economies, Cycplopentane will be in good demand due to its stability.

Besides the variability of prices of the raw materials are also another essential element for the development of Cyclopentane market. As Cyclopentane production generally uses crude oil and natural gas as raw materials, price variations in these feedstocks can significantly influence Cylcopentane's production cost. Companies and other paticipants of the Cyclopentane market should seek their positioning in the market to cover their profitability against these price fluctuations.

Governmental restrictions and policies are also a major factor which the market of Cyclopentane depends on. A set of rules about the use of high GWP refrigerants in different applications has generated a turnaround resulting in the utilisation of green solutions such as cyclopentanes. Governments from all over the world are adopting policies aimed at reduced use of certain chemicals or in opposition to them and this means industries going green.

Additionally, through the emergence of new technologies and production again, the cyclopentane marketplace continually grows. On-going improvements of the process of cyclopentane production are being undertaken to boost its profitability and reduce harmful impacts on the environment.

Leave a Comment